TDS Return Filing Consultant in Ahmedabad

Looking for a TDS Return Filing Consultant in Ahmedabad? At Legal Raja, we offer expert TDS compliance services to businesses, professionals, and organizations across Ahmedabad. Our team ensures accurate preparation and timely filing of TDS returns (Form 24Q, 26Q, 27Q, 27EQ) while helping you avoid penalties and stay compliant with Income Tax regulations.

Find Trusted TDS Filing Experts Near You

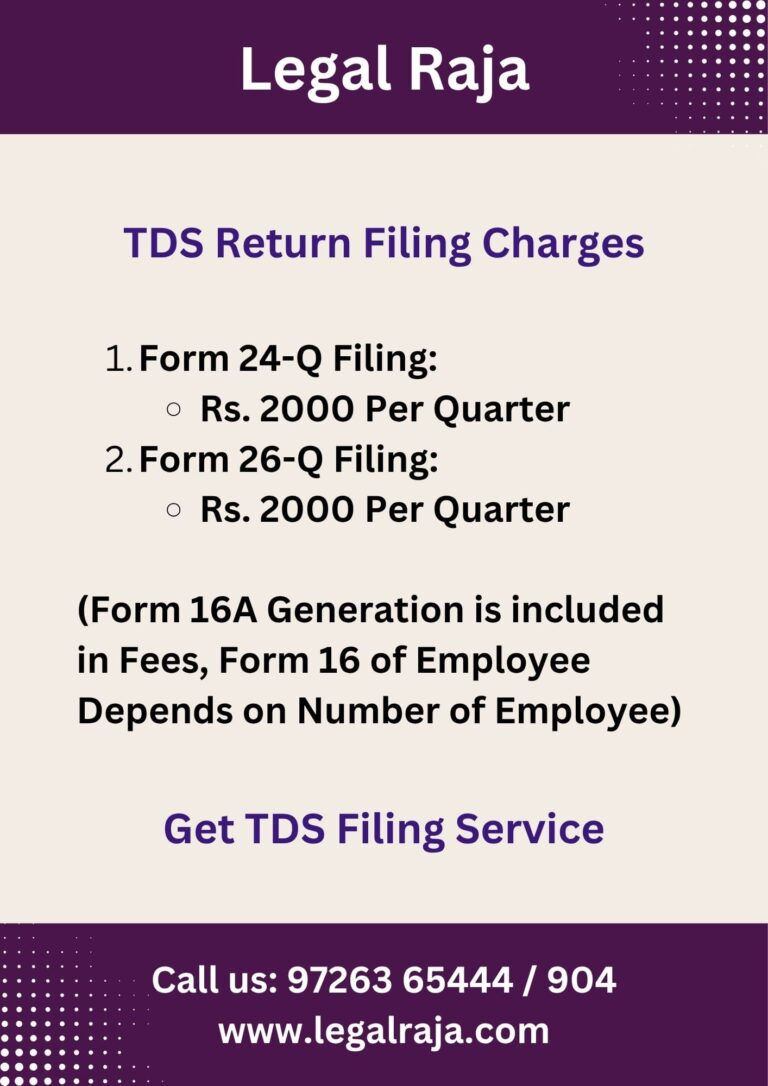

TDS Return Filing Package

- Form 24Q – ₹2,000/Quarter

- Form 26Q – ₹2,000/Quarter

- Form 16A Generation – Free

- Form 16 for Employees

📍 For Salaries, Rent, Fees, Contractors | Expert Support | Timely & Compliant Filing

Complete Guide to TDS Return Filing for Businesses

TDS (Tax Deducted at Source) Return Filing is a mandatory compliance for businesses that deduct TDS on payments like salaries, contractor bills, rent, interest, and professional fees. Every deductor must file quarterly TDS returns using forms like 24Q, 26Q, 27Q, or 27EQ, depending on the nature of the transaction.

If you’re looking for professional help, a TDS Return Filing Consultant in Ahmedabad like Legal Raja can assist with end-to-end filing, challan verification, and accurate submission—helping you avoid penalties and mismatches. Timely and correct filing also ensures that the tax deducted reflects correctly in the payee’s Form 26AS.

Whether you’re a small business or a growing enterprise, partnering with a trusted consultant ensures error-free, on-time TDS compliance and peace of mind.

TDS Filing Charges in Ahmedabad – Know the Cost

At Legal Raja, our TDS Return Filing Consultant in Ahmedabad are designed to suit businesses of all sizes. While the final package depends on the volume of transactions and number of employees, we offer affordable pricing for medium-scale businesses:

Form 24Q Filing (Salary TDS): ₹2,000 per quarter

Form 26Q Filing (Non-salary TDS): ₹2,000 per quarter

Form 16A generation is included at no extra cost

Form 16 for employees – charges vary based on employee count

Whether you’re handling salaries, professional fees, rent, or contractor payments, our expert team ensures timely and compliant TDS filing—so you stay penalty-free and audit-ready.

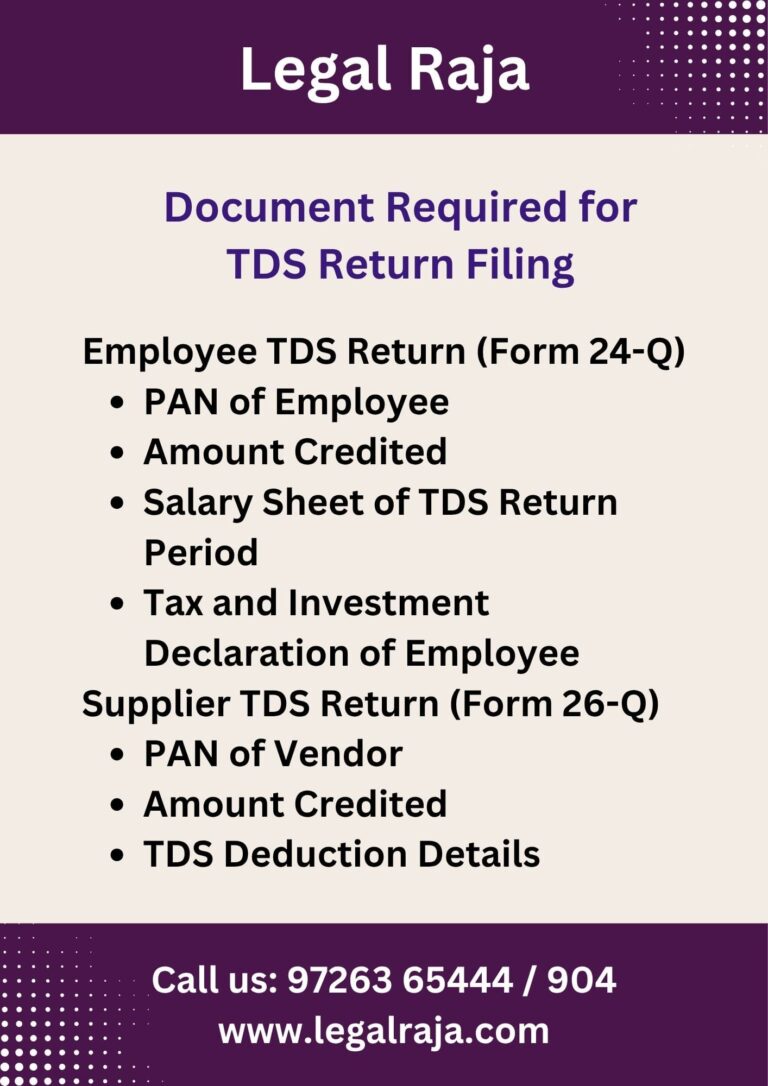

Checklist of Documents for TDS Return Filing in Ahmedabad

TDS Deduction Rules – Know When It Applies

TDS (Tax Deducted at Source) is applicable when certain types of payments are made, such as salaries, professional fees, rent, contractor payments, interest, or commission. If you’re a business, company, or even an individual making such payments above the threshold limit prescribed by the Income Tax Act, you’re required to deduct TDS before making the payment.

The rate of TDS and the applicability depends on:

Nature of payment

Amount involved

Type of recipient (individual, firm, or company)

PAN availability of the payee

Failing to deduct or deposit TDS on time can result in penalties, interest, and disallowance of expenses. That’s why it’s important to understand when TDS applies and at what rate. A professional TDS Return Filing Consultant in Ahmedabad like Legal Raja can help ensure timely deduction, accurate payment, and proper return filing—keeping you compliant and protected from penalties.

TDS Payment & Return Filing Due Dates Explained

To stay compliant with TDS regulations, businesses must follow two key deadlines: TDS payment deposit and TDS return filing.

TDS Payment Due Dates:

For April to February, TDS must be deposited by the 7th of the following month

(e.g., TDS for April must be paid by 7th May)For March, the due date is 30th April

TDS Return Filing Due Dates (Form 24Q & 26Q):

Q1 (April–June): 31st July

Q2 (July–September): 31st October

Q3 (October–December): 31st January

Q4 (January–March): 31st May

Additionally, Form 16 (for employees) and Form 16A (for vendors) must be generated and issued within the prescribed timelines after return filing.

Step-by-Step Process for TDS Return Filing

Start by sending us the required data—like salary sheets, vendor details, PAN information, and TDS amounts—based on the type of return (24Q for employees, 26Q for vendors).

Our experts will carefully prepare your TDS return (Form 24Q or 26Q) ensuring all entries are accurate and fully compliant with current tax laws.

Once verified, we file your TDS return and generate Form 16A (for vendors) and Form 16 (for employees), so you’re ready for distribution and audit-proof compliance.

TDS Consultancy Services We Offer in Ahmedabad

At Legal Raja, we offer end-to-end TDS compliance support designed to keep your business stress-free and penalty-proof. As a reliable TDS Return Filing Consultant in Ahmedabad, our service covers every stage of the process:

Accurate TDS Calculation based on payment type and applicable rates

Timely TDS Payment to the government portal to avoid interest and penalties

Preparation of TDS Returns (Forms 24Q, 26Q, etc.) with complete data accuracy

Filing of TDS Returns with confirmation and follow-up

Generation of Form 16 & Form 16A for employees and vendors

Best TDS Consultants in Ahmedabad for Quick Filing

Legal Raja offers professional TDS Return Filling Consultant in Ahmedabad. including TDS calculation, challan payment, Form 24Q/26Q filing, and Form 16 generation. Our expert team ensures accurate and timely compliance for businesses, professionals, and employers across India. Contact us for hassle-free TDS filing.

- Contact Legal Raja: 9726365444

- Email: office@legalraja.com

- Head Office: Ahmedabad, Gujarat – Serving All India

FAQs on TDS Return Filling

What is TDS Return Filing?

TDS Return Filing is the process of submitting a statement to the Income Tax Department about the tax deducted at source from payments like salary, rent, professional fees, etc.

Who needs to file TDS Returns?

Any individual or business that deducts TDS is required to file quarterly TDS returns.

How often should TDS returns be filed?

TDS returns must be filed every quarter (4 times a year).

What happens if I don’t file TDS returns on time?

Late filing attracts a penalty of ₹200 per day and may also lead to further legal action.

Can I file TDS returns online?

Yes, TDS returns can be filed online through the TRACES or NSDL website, or you can consult a professional for smooth filing.