Tax Audit Services in Ahmedabad

Looking for Tax Audit Services in Ahmedabad? Legal Raja offers expert Chartered Accountant support for businesses and professionals who need to comply with income tax rules. If your turnover exceeds the legal limit, a tax audit is mandatory. Our team ensures accurate audit reports, timely filings, and complete peace of mind – all at an affordable price.

Searching for a CA for Tax Audit? We’re Close By!

- Books of Accounts Preparation

- Final Accounts

- Tax Audit Filing

- ITR Filing

- DSC for Filing

Rs. 10,000/-

📍 Complete Tax Compliance | CA-Assisted | Ahmedabad & PAN India

Chartered Accountant for Income Tax Audit

As per Section 44AB of the Income Tax Act, 1961, a tax audit is mandatory for any taxpayer whose business turnover exceeds ₹1 crore, or ₹50 lakhs for professionals in a financial year. Even if turnover is below ₹1 crore, tax audit still applies if net profit is less than 8% (or 6% in case of digital/banking transactions). However, businesses having 95% or more sales and expenses through banking channels are exempted from audit up to ₹10 crore turnover.

At Legal Raja, we offer expert Tax Audit Services in Ahmedabad, ensuring smooth and timely compliance across India. A practicing Chartered Accountant (CA) is authorized to conduct the tax audit and must submit a detailed audit report in Form 3CA-3CD or 3CB-3CD along with financial statements like the Profit & Loss Account and Balance Sheet.

Just share the required documents, and our experienced team will handle the entire process. We ensure your tax audit filing is completed before the due date, 30th September, helping you stay fully compliant and penalty-free.

Complete Income Tax Audit Service Package

We offer a comprehensive income tax solution that covers everything you need for smooth and compliant filing. Our all-in-one Tax Audit Services in Ahmedabad package is designed to simplify the entire process for businesses and professionals.

Tax Audit Combo Package – ₹10,000/- Only

Preparation of Books of Accounts by a dedicated accountant (separate from the audit CA)

Finalization of Financial Statements – Profit & Loss Account, Balance Sheet, etc.

Tax Audit Report Filing by a Chartered Accountant (Form 3CA/3CB & 3CD)

Income Tax Return (ITR) Filing

Digital Signature Certificate (DSC) for authentication

With this package, all your income tax-related compliance needs are managed under one roof – efficiently, accurately, and on time.

Contact us today to get started with your Tax Audit Combo Package.

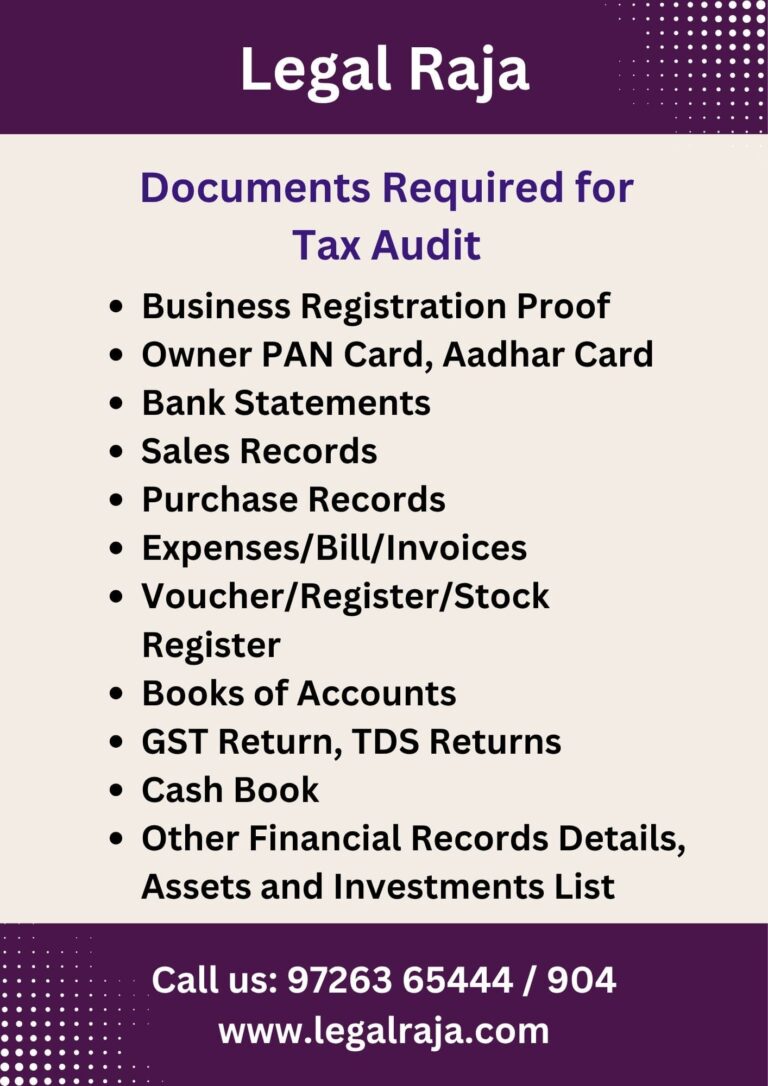

Document Checklist for Tax Audit in Ahmedabad – What You Need

Documents Needed for Income Tax Audit – Ahmedabad

Business Registration, PAN & Aadhar

Bank Statements (All Accounts)

Sales & Purchase Bills

Expense Bills & Vouchers

Stock/Voucher Registers

Books of Accounts (Ledger, Cash Book, etc.)

GST & TDS Return Copies

Cash Book Details

Asset & Investment List

Any other documents as requested by CA

Why Tax Audit Matters: Key Benefits for Businesses

A tax audit is more than just a legal requirement—it plays a vital role in maintaining the financial health of your business. It helps ensure that your accounts are accurate, tax filings are correct, and you stay compliant with income tax laws. A proper audit by a Chartered Accountant also builds trust with investors, banks, and government authorities.

Key benefits include:

✔ Improved accuracy in financial reporting

✔ Early detection of errors or irregularities

✔ Helps avoid penalties and interest from non-compliance

✔ Boosts business credibility for loans and tenders

✔ Ensures transparency and confidence in business operations

A tax audit brings discipline to your financial systems and supports long-term growth by ensuring legal and financial clarity.

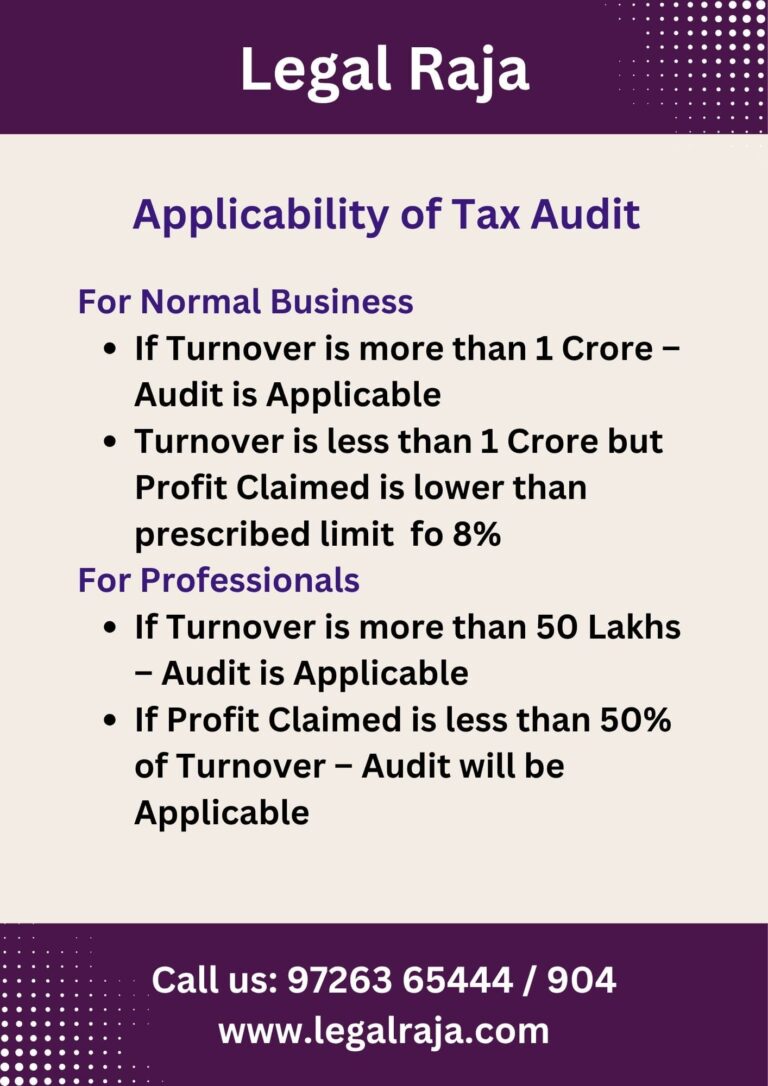

FY 2023-24 Tax Audit Applicability as per Section 44AB

The need for a tax audit depends mainly on two factors: your annual turnover/gross receipts and the profit you declare in your income tax return.

For Businesses (Section 44AB)

Turnover exceeds ₹1 Crore

– Tax audit is mandatory.

– Exception: If your turnover is up to ₹10 Crore and at least 95% of all receipts and payments are through banking channels (i.e., cash transactions are 5% or less), then you can opt for presumptive taxation under Section 44AD, and tax audit is not required.Turnover is below ₹1 Crore

– Tax audit is required if:You declare profits below 8% of turnover (or 6% if receipts are via digital/banking mode), or

You report a business loss.

For Professionals (Section 44ADA)

Gross receipts exceed ₹50 Lakhs

– Tax audit becomes mandatory.Profit reported is less than 50% of total receipts under presumptive taxation

– Audit is compulsory, even if gross receipts are below ₹50 Lakhs.

Get Your Tax Audit Filed by CA in Just 3 Days

Begin by contacting us and submitting the required documents for your tax audit. Once we receive your inquiry, we’ll guide you on exactly what’s needed.

Our expert CA will review your records and conduct the audit. If anything additional is needed, we’ll request it. Once the audit is done, a draft audit report will be shared with you for approval.

After your approval, the CA will file the Income Tax Audit Report on the official portal. You’ll also receive a physically signed report with UDIN for your records.

Key Points to Know Before a Tax Audit

Maintain Proper Accounting

– Accurate books of accounts are the backbone of a tax audit. Using double-entry accounting is a basic requirement.Audit Filing Deadline

– The tax audit report must be filed on or before 30th September of the assessment year to avoid penalties.UDIN is Mandatory

– The Chartered Accountant must issue a Unique Document Identification Number (UDIN) for every tax audit report filed.Digital Signature Required

– The owner or company representative must use a valid digital signature to approve and submit the audit report.

Find a Trusted Tax Audit Consultant in Your Area

Legal Raja offers expert Tax Audit Services in Ahmedabad, Gujarat, and India. Our experienced Chartered Accountants handle everything from books review, audit report filing (Form 3CA/3CB & 3CD), ITR filing, to UDIN & DSC management.

Contact Legal Raja: 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving All India

FAQ's on One Person Company Registration

What is a tax audit?

A tax audit is a review of your financial records by a Chartered Accountant to ensure accuracy and compliance with Income Tax laws, mainly under Section 44AB.

Who needs to get a tax audit done?

Businesses with turnover above ₹1 crore, and professionals earning above ₹50 lakhs in a year generally need a tax audit. Also, if you’re showing lower profit than the prescribed limit under presumptive schemes, audit is mandatory.

Who conducts the tax audit?

Only a Chartered Accountant (CA) in practice can conduct and certify a tax audit report.

Is UDIN compulsory for tax audit?

Yes, every audit report filed by a CA must be verified with a Unique Document Identification Number (UDIN).