Statutory Audit Services in Ahmedabad

Statutory Audit is a mandatory financial compliance requirement for companies and LLPs under the Companies Act and other applicable laws. At Legal Raja, we provide expert Statutory Audit Services in Ahmedabad through our qualified team of Chartered Accountants. Our audit process ensures that your financial statements present a true and fair view of your business operations while meeting all legal and regulatory standards. Whether you’re a private limited company, LLP, or large enterprise, we deliver accurate, timely, and compliant audit reports to help you stay penalty-free and investor-ready.

Find a Trusted Statutory Auditor for Your Company Today!

- Statutory Audit Report

- Income Tax Return (ITR) Filing

- ROC Annual Filing

- DIN KYC for Directors

- DPT-3 & MSME Return Filing

- AGM & Board Meeting Docs

Rs. 19,999/-

📍 CA-Handled | Complete Compliance | PAN India Service

Company Statutory Audit Solutions by Expert CAs

Ensure financial integrity and regulatory compliance with our expert Statutory Audit Services in Ahmedabad. Every registered company—whether it’s a Private Limited, Public Limited, OPC, LLP, or Section 8 Company—is legally required to conduct a statutory audit annually, as per the Companies Act, 2013. This obligation applies even if the company has had no financial transactions during the year. The audit must be carried out by a practicing Chartered Accountant (CA) who reviews the financial records, checks compliance, and issues a certified audit report.

The objective of a statutory audit goes beyond legal formality—it builds credibility, transparency, and stakeholder trust. A well-executed audit assures investors, banks, regulators, and partners that the company’s financial statements are accurate and in line with accounting standards and laws.

At Legal Raja, we offer reliable and timely Statutory Audit Services in Ahmedabad, handling everything from books preparation to filing the audit report with the Registrar of Companies (ROC). Our experienced CAs ensure a seamless process, helping your business stay compliant, confident, and audit-ready.

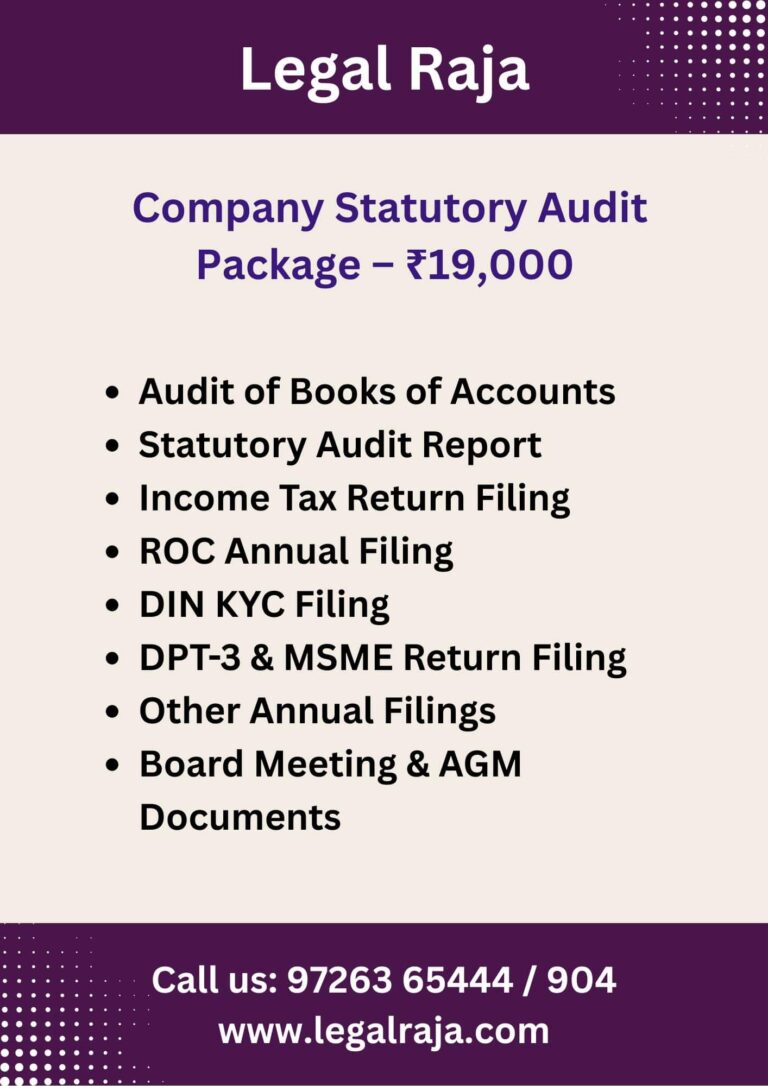

All-Inclusive Statutory Audit Service Package

We offer a complete statutory audit and annual compliance package for Private Limited Companies, handled by experienced Chartered Accountants. Priced at just ₹19,000, this combo covers everything you need for a smooth and legally compliant financial year.

- Audit of Books of Accounts

- Statutory Audit Report

- Income Tax Return Filing

- ROC Annual Filing

- DIN KYC Filing

- DPT-3 & MSME Return Filing

- Other Annual Filings

- Board Meeting & AGM Documents

With our Company Statutory Audit Package, you get a one-stop solution for all your compliance needs—accurate, timely, and stress-free.

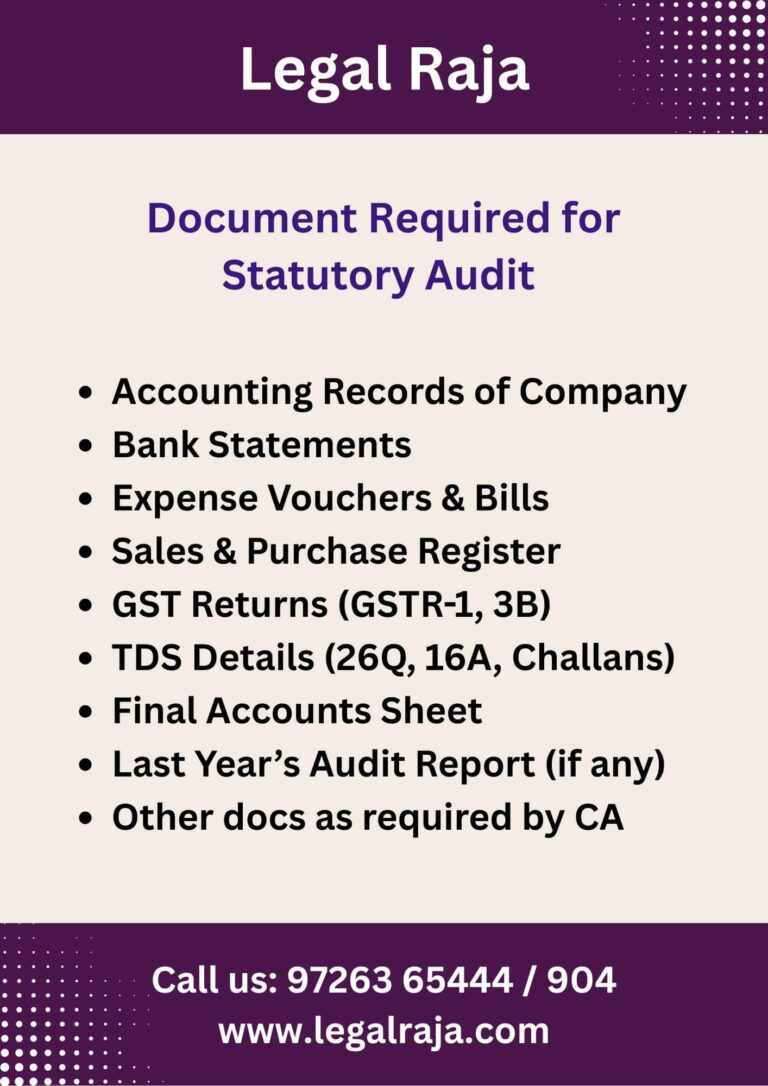

Essential Documents for Statutory Audit of a Company

Accounting Records of the Company (Ledger, Journal, Trial Balance)

Bank Statements (All company accounts for the audit year)

Expense Vouchers (Supporting bills/invoices for payments made)

Sales Register

Purchase Register

GST Returns & Data (GSTR-1, GSTR-3B, etc.)

TDS Data (Form 26Q, 16A, and payment challans)

Final Accounts

Profit & Loss Statement

Balance Sheet

Previous Year’s Annual Report (If applicable)

Any Other Documents requested by the CA during the audit process

Understanding the Legal Applicability of Company Statutory Audit

Private Limited Company

– Mandatory statutory audit, irrespective of turnover or profit.One Person Company (OPC)

– Audit is mandatory every financial year.Section 8 Company (Non-profit organization)

– Statutory audit is compulsory under the Companies Act.Public Limited Company

– Mandatory audit for all public companies.Limited Liability Partnership (LLP)

– Audit required if:Capital contribution exceeds ₹25 lakhs, or

Annual turnover exceeds ₹40 lakhs

Chartered Accountant for Statutory Audit

At Legal Raja, we offer professional Statutory Audit Services in Ahmedabad to ensure your company remains fully compliant with the Companies Act. A Statutory Auditor, as defined by law, must be a qualified Chartered Accountant (CA), and only a CA is authorized to conduct the statutory audit of a company’s financial records.

As per the Chartered Accountants Act, 1949, a CA can handle a maximum of 20 company audits, ensuring focused attention and high-quality service for each client.

Our audit package is designed to deliver accuracy, transparency, and timely compliance. With Legal Raja, you can expect reliable audit support, detailed financial reviews, and complete assistance in filing your statutory reports.

Step-by-Step Statutory Audit Procedure for Companies

Simply share the necessary documents with our team. Our experts will review them thoroughly and request any additional details, if needed, to ensure nothing is missed.

Once documents are verified, our Chartered Accountants will conduct the audit in accordance with statutory standards. We will then prepare the Audit Report and complete related filings such as Income Tax Return (ITR) and other mandatory submissions.

We guarantee timely completion of the entire audit process. All required reports and filings will be submitted within due dates—ensuring full legal compliance for your company.

Role of Chartered Accountant under Companies Act, 2013

A Chartered Accountant (CA) plays a key role in helping companies follow the rules set by the Companies Act, 2013. Here’s how:

Statutory Audit: A CA is responsible for checking the company’s financial records and preparing the Statutory Audit Report, which confirms whether the company’s accounts are accurate and legal.

Compliance Check: CAs ensure that the company is following all financial and legal rules like proper maintenance of books, filing returns, and disclosures.

Filing of Reports: CAs prepare and file various reports with government authorities such as the Registrar of Companies (ROC) and Income Tax Department.

Appointment as Auditor: Under the Companies Act, only a qualified CA can be appointed as the Statutory Auditor of a company.

Fraud Detection & Reporting: If the CA finds any fraud or misuse in the accounts, they are legally bound to report it to the authorities.

Advisory Role: Apart from audits, CAs also guide companies on tax planning, financial decisions, and improving internal control systems.

In short, a Chartered Accountant ensures transparency, trust, and legal compliance in a company’s financial matters.

Professional Statutory Auditor Near Me

Legal Raja is your reliable partner for Statutory Audit Services in Ahmedabad, serving clients across Gujarat and India. We specialize in conducting company audits as mandated under the Companies Act, 2013, ensuring full legal and financial compliance. Our end-to-end statutory audit package includes:

Contact Legal Raja: +91 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving Clients Across India

Frequently Asked Questions on Statutory Audit of Company

What is a Statutory Audit?

A Statutory Audit is a mandatory audit of a company’s financial records conducted by a qualified Chartered Accountant (CA) as per the Companies Act, 2013.

Who can conduct a Statutory Audit?

Only a Chartered Accountant (CA) in practice, or a CA firm, can be appointed as a Statutory Auditor for a company.

Is Statutory Audit mandatory for all companies?

Yes, Statutory Audit is mandatory for all Private Limited Companies, One Person Companies (OPC), Public Limited Companies, and Section 8 Companies, regardless of turnover or profit.

How many companies can one CA audit?

As per the Chartered Accountants Act, 1949, a CA can audit a maximum of 20 companies at a time.

What happens if a company fails to conduct Statutory Audit?

Non-compliance leads to penalties and fines on both the company and its directors, as per Section 143 & 147 of the Companies Act, 2013.