ROC Filing Consultant in Ahmedabad

Looking for a trusted ROC Filing Consultant in Ahmedabad? We specialize in annual compliance for Private Limited Companies, LLPs, and OPCs, including AOC-4, MGT-7, DIR-3 KYC, ADT-1, and other MCA filings. Our experienced team ensures your company stays fully compliant with the Ministry of Corporate Affairs (MCA) regulations – avoiding penalties and last-minute hassles.

Need help with ROC filing or MCA compliance?

- AOC-4 – Financial Statements

- MGT-7 – Annual Return

- ADT-1 – Auditor Appointment

- DIN KYC – Director KYC Update

- LLP Forms 11 & 8 – Annual Filing

- End-to-End Filing Support

- DSC Renewal

Rs. 9,999/-

ROC Annual Return Filing with Professional Support

As a trusted ROC Filing Consultant in Ahmedabad, we offer complete support for companies and LLPs to meet their annual compliance requirements under the Ministry of Corporate Affairs (MCA). ROC annual return filing is a mandatory process, and with professional guidance, it becomes accurate, timely, and hassle-free. Our expert team handles the preparation and filing of important forms like AOC-4, MGT-7, ADT-1, and DIR-3 KYC, ensuring your business remains fully compliant. Whether you operate a Private Limited Company, LLP, or OPC, we help you avoid penalties and legal delays. From document collection to digital signature handling and final ROC submission, we manage the entire process—so you can focus on growing your business with peace of mind.

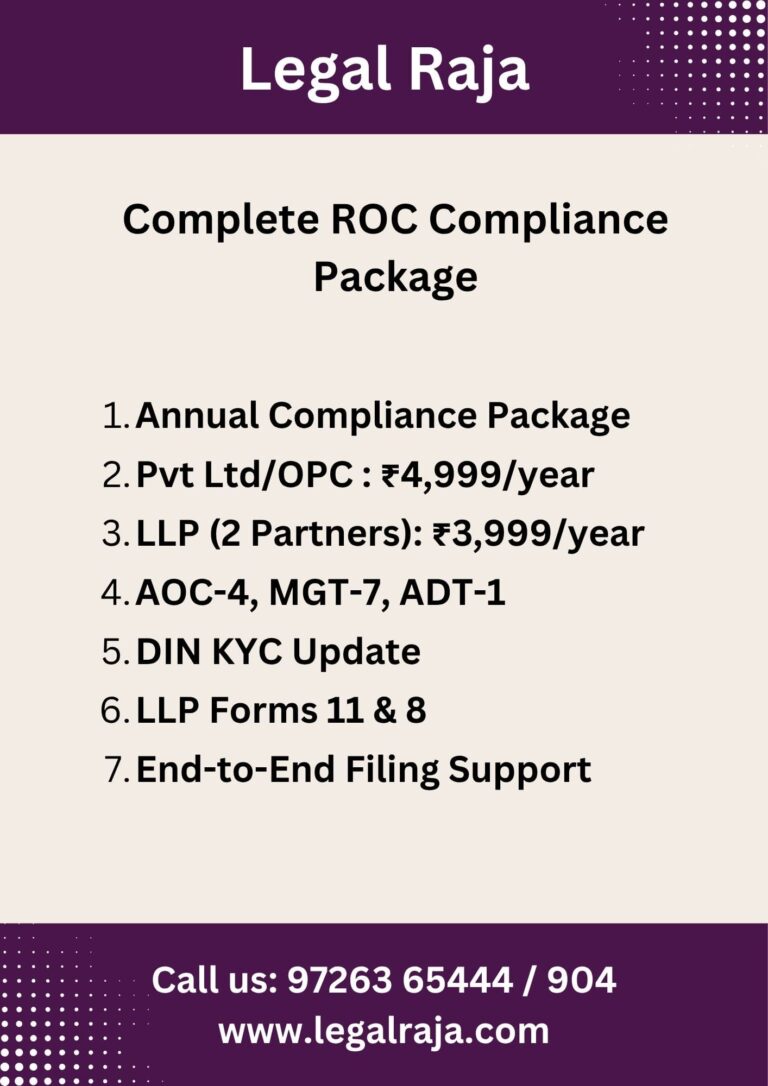

All-Inclusive ROC Filing Package

Running a company means staying compliant every year. As a leading ROC Filing Consultant in Ahmedabad, we offer a comprehensive ROC/MCA Filing Package that takes care of all your annual return filing needs with the Ministry of Corporate Affairs (MCA). Our expert team ensures you never miss a deadline or face penalties.

Fees (All Inclusive):

Private Limited / OPC: ₹4,999/- per year

LLP (up to 2 partners): ₹3,999/- per year

Additional services like DSC, late fees, or DIN activation – charged separately if needed

What’s Included:

AOC-4 Filing – Financial Statements

MGT-7 Filing – Annual Return

ADT-1 Filing – Auditor Appointment (if due)

Director KYC – DIN KYC Update

Form 11 & Form 8 – For LLPs

Basic Guidance & Support – We handle everything from preparation to submission

Digital Signature Renewal – If required (extra cost)

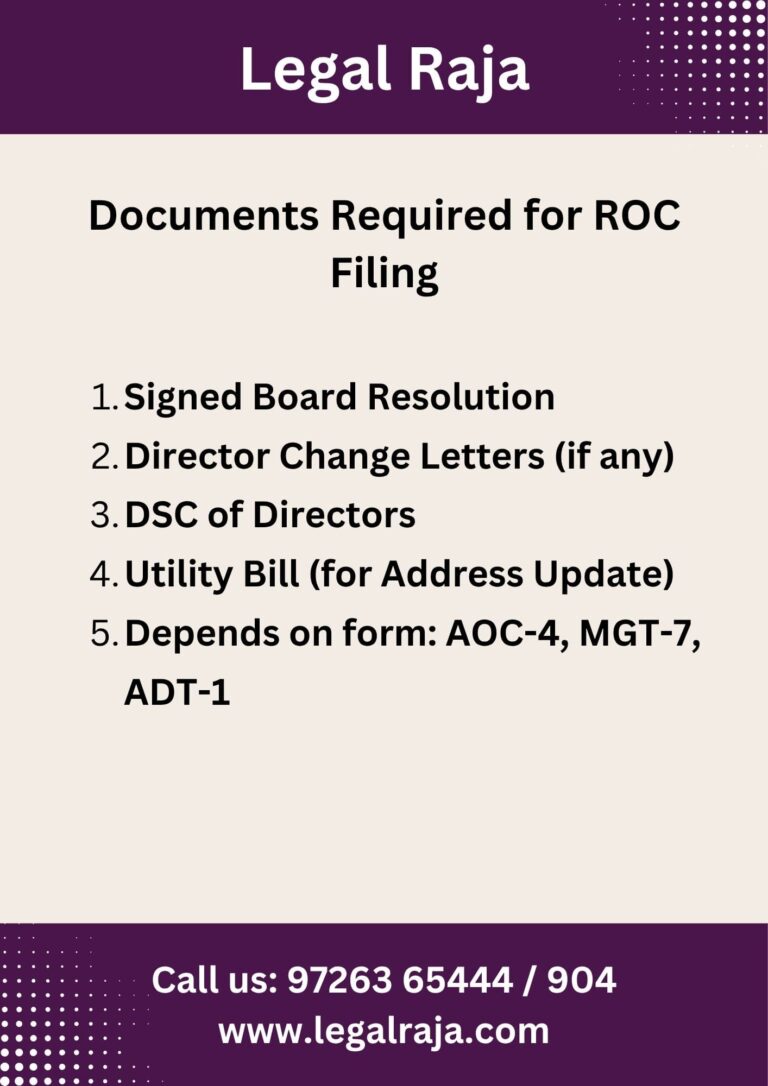

Documents Required for MCA Filing

The specific documents for ROC filing depend on which form you’re submitting (AOC-4, MGT-7, ADT-1, etc.). However, here are some commonly required documents across most filings:

Signed Board Resolutions

Director Appointment/Resignation Letters (if any changes)

Digital Signature (DSC) of Directors

Latest Utility Bill (for address change)

Essential MCA Forms for Annual Compliance

INC-20A – Start of Business Declaration

ADT-1 – Auditor Appointment

MGT-7 & AOC-4 – Annual Company Filings

Form 8 & 11 – LLP Annual Compliance

DIR-12 – Director/KMP Changes

DIR-3 – New DIN Application

SH-7 – Share Capital Changes

ADT-3 – Auditor Resignation

CHG-1 – Loan/Charge Creation

INC-22 – Address Update

DPT-3 – Loan/Deposit Return

MSME – MSME Creditors Report

DIR-3 KYC – Director’s Annual KYC

Use the right form at the right time to stay MCA compliant.

Annual MCA Compliance Simplified for Businesses

As a trusted ROC Filing Consultant in Ahmedabad, we ensure that all companies and LLPs stay legally compliant by filing their annual returns on time with the Ministry of Corporate Affairs (MCA).

Key Filings:

AOC-4 – Financial Statements

MGT-7 – Annual Return

ADT-1 – Auditor Appointment

DIR-3 KYC – Director KYC

Form 8 & 11 – For LLPs

Step-by-Step Process to Get ROC Filing Done

Send us the required documents like financial statements, director details, and company info. We’ll guide you if anything is missing.

Our experienced CA/CS team will prepare the necessary ROC forms (AOC-4, MGT-7, etc.) based on your details.

We digitally sign and submit the forms on the MCA portal. You get proof of filing and complete compliance—hassle-free.

MCA Filing Requirements for Company Events & Updates

As a reliable ROC Filing Consultant in Ahmedabad, we help businesses stay compliant not just with annual returns but also with timely event-based filings. Apart from yearly filings, companies are required to report specific changes or updates to the Ministry of Corporate Affairs (MCA) through ROC forms. These are known as event-based filings and must be submitted as and when the event occurs.

Here are some of the most common ones:

Director Addition – File when appointing a new director

Director Removal – Required when a director resigns or is removed

Company Address Change – Must update ROC when shifting office location

Auditor Changes – File for appointment, resignation, or removal of auditor

Share Capital Alteration – Report increase or restructuring of share capital

Loan/Charge Creation – Mandatory when a company takes a secured loan

Change in Company Objectives – File if your business purpose is modified in MOA

Timely filing of these forms ensures your company stays legally updated and avoids penalties.

Trusted ROC Filing Expert in Ahmedabad

Legal Raja is your go-to ROC Filing Consultant in Ahmedabad, offering hassle-free ROC/MCA compliance services for Private Limited, LLP, and OPC firms across Gujarat and India. Our expert team of Chartered Accountants and Company Secretaries efficiently handles all key filings including AOC-4, MGT-7, ADT-1, DIR KYC, as well as event-based filings like director appointment/removal, address change, and share capital updates.

✅ All filings, one trusted team. Stay compliant, stay stress-free.

Contact Legal Raja: 972636544

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving All India

Frequently Asked Questions on MCA & ROC Filings

What is ROC filing?

ROC (Registrar of Companies) filing refers to submitting mandatory returns and documents with the Ministry of Corporate Affairs (MCA) to comply with the Companies Act.

Who needs to file ROC returns?

All registered entities – Private Limited, LLP, OPC, and Section 8 Companies – must file annual ROC returns, even if there’s no business activity.

What happens if I miss the ROC filing deadline?

Late filing attracts a penalty of ₹100 per day per form, with no upper limit. It may also lead to company status being marked as non-compliant.

Do dormant or inactive companies also need to file?

Yes. Even if the company had no transactions, ROC filing is still mandatory.