Property Valuation Consultant in Ahmedabad

Looking for a reliable property valuation consultant in Ahmedabad? Whether you need a certified valuation report for home loans, legal disputes, visa applications, or property sale/purchase, our expert valuers provide accurate and government-recognized reports. We assess residential, commercial, and industrial properties, ensuring compliance with bank, court, and embassy standards. Get fast, professional service with complete documentation support.

Quick Property Valuation Report in Just 3 Hours

- 3500/- for VISA Purpose

- 12,000/- for Income Tax

- 6,000/- for FMV/Sale

- 8,000/- Bank Loan Purpose

Property Valuation

By Chartered Engineer

Govt. Approved Valuer

Get Now

Govt. Registered Property Valuer for Accurate Reports

In India, property valuation is conducted by certified professionals recognized by government authorities. These professionals often include Chartered Engineers, Civil Engineers, and Architects. Depending on their area of practice, they may also be classified as Income Tax Approved Valuers, Bank/NBFC Empaneled Valuers, or those affiliated with various government agencies. If you’re looking for a Property Valuation Consultant in Ahmedabad, our team offers certified valuation services tailored for a variety of purposes. Property valuation is commonly required for immigration and VISA applications, wealth documentation, bank loans, financial reporting, property sales, and income tax assessments. We provide valuation reports for all types of immovable assets, including residential homes, bungalows, flats, commercial shops, offices, showrooms, and even agricultural or open land.

In recent times, the demand for property valuation services in Ahmedabad has grown significantly, especially for corporate reporting, IFRS/Ind AS compliance, and audit purposes. We use multiple valuation methods such as comparable market analysis, area-wise valuation, Jantri value (stamp duty), realizable value, and insurable value to ensure the most accurate results.

For trusted and timely property valuation reports in Ahmedabad, especially for VISA or legal needs, connect with our government-approved property valuers today.

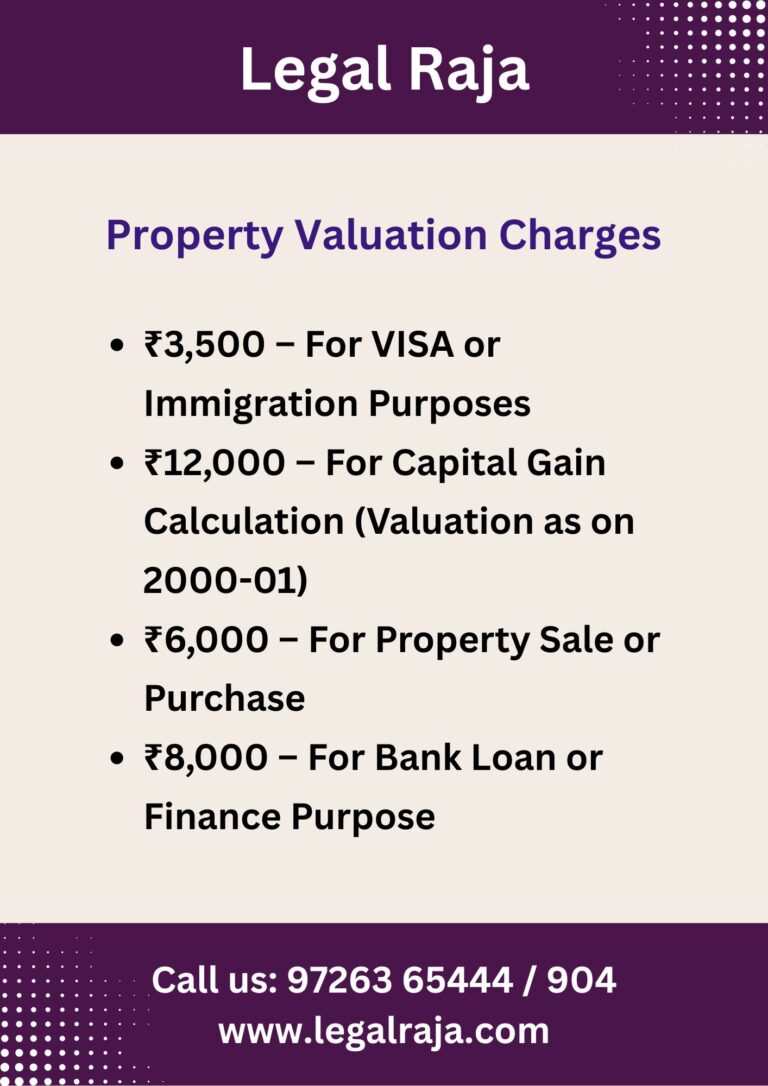

Property Valuation Fees by Approved Valuers in Ahmedabad

We are your trusted local Property Valuation Consultant in Ahmedabad, specializing in accurate valuation of residential and commercial properties. Whether you need a report for immigration, tax, or financial purposes, our certified valuers are here to help. Our valuation charges are as follows:

₹3,500 – For VISA or Immigration Purposes

₹12,000 – For Capital Gain Calculation (Valuation as on 2000-01)

₹6,000 – For Property Sale or Purchase

₹8,000 – For Bank Loan or Finance Purpose

We ensure quick, professional, and government-accepted valuation reports tailored to your specific needs.

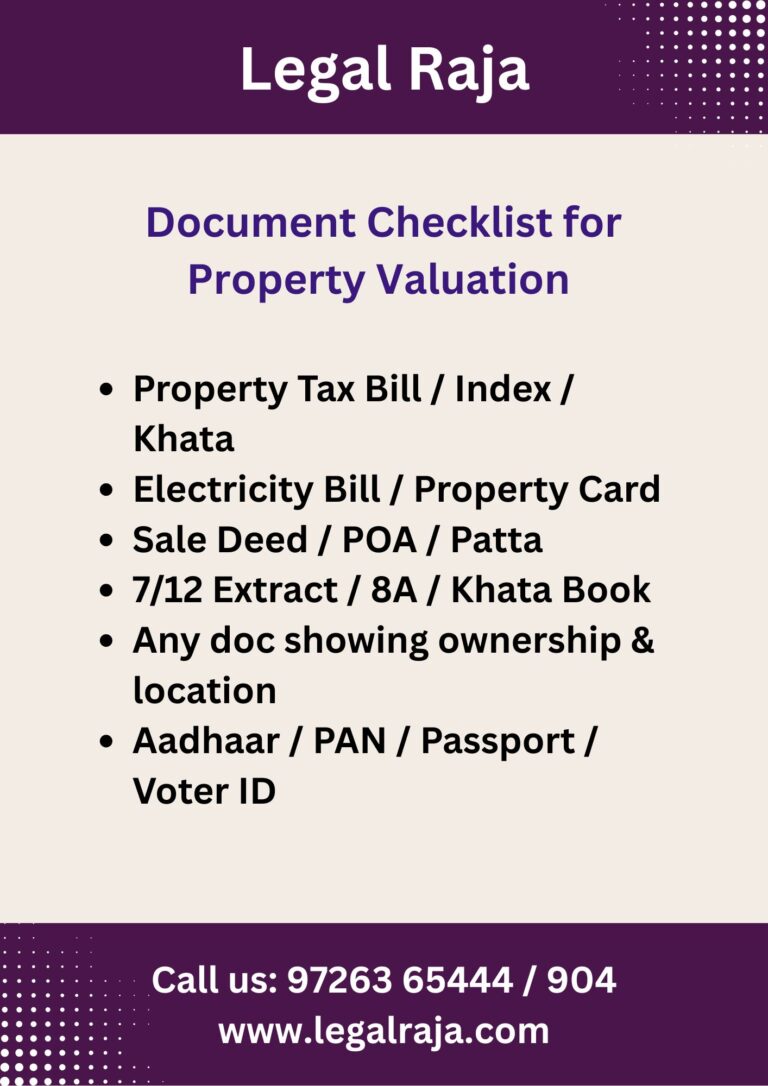

Documents Required for Property Valuation in Ahmedabad

To carry out a property or asset valuation, certain documents are needed to verify ownership and identity. Here’s a quick guide to what you need to submit:

1. Ownership Proof – Any One of the Following (Based on Property Type):

For House, Building, Office, Apartment, or Flat:

Property Tax Bill

Index Copy

Municipal Khata

Electricity Bill

Property Card

Power of Attorney (POA) or Registered Sale Deed

For Agricultural Land:

Patta Record

7/12 Extract or 8A Survey Record

Registered Sale Deed

Khata Book

For Other Properties (e.g., open land or plots):

Any document showing the area, location, and ownership of the property

2. Owner’s Identity Proof – Any One of the Following:

Aadhaar Card

PAN Card

Passport

Voter ID Card

These documents help the valuer verify the property details and prepare an accurate and legally valid valuation report. Make sure the copies are clear and up to date.

Why You Need a Property Valuation Report

A Property Valuation Report is commonly used as a supporting document to show proof of asset ownership or wealth. However, its use extends far beyond just financial worth. Depending on the situation, a valuation report serves various important purposes, including:

Student Visa Applications – To demonstrate financial capability by showing asset value.

Immigration or Visitor Visa – Used to establish the applicant’s financial background and ties to their home country.

Mortgage or Bank Loans – Required by banks and lenders to assess the current market value of the property before sanctioning a loan.

Home Insurance – Helps determine the insured value of a property.

Income Tax or Capital Gain – Useful while calculating capital gains tax during property sale, especially when determining cost inflation index.

Accounting or Ind AS (IFRS Reporting) – Companies use it for financial reporting and compliance with international accounting standards.

Audit Requirements – Required by auditors to verify the actual market value of assets held.

To Know Market Value – Helpful for property owners who want to know the current value for sale, investment, or wealth planning.

If you’re looking for a Property Valuation Consultant in Ahmedabad, Legal Raja provides certified valuation reports prepared by licensed Chartered Engineers—ensuring legal validity, accuracy, and acceptance by banks, embassies, auditors, and government authorities. In short, a Property Valuation Report plays a vital role in financial, legal, immigration, and business scenarios, ensuring transparent and accurate property value disclosure.

Understanding Valuation Methods for Immovable Assets

The most reliable and widely accepted way to assess property value is through a valuation report by a recognized Chartered Engineer near you. However, several other methods are also used depending on the purpose of valuation. These include:

Market Value by Chartered Engineer: Accurate and certified value assessment used for legal, visa, and financial purposes.

Insurable Value: The cost to rebuild or replace the property, used for home insurance.

Realizable Value: The amount that can be obtained by selling the property quickly, usually in urgent sale scenarios.

Government Value: Also known as Jantri, Circle Rate, or Stamp Duty Value, this is the value fixed by the government for tax and registration purposes.

Comparable Market Value: Estimated by comparing recent sale prices of similar properties in the same area.

Cost of Acquisition: The original purchase price or book value, often used in capital gains and accounting.

Each method serves a specific purpose and helps in understanding the property’s worth in different situations.

Online Property Valuation Services – Fast & Reliable

Share relevant documents based on your property type. This includes proof of ownership and a valid ID of the owner. These help us begin the valuation accurately.

Our team prepares a draft valuation report based on your documents. You’ll receive it for review — simply check the details and confirm approval for finalization.

Once approved, our certified Chartered Engineer will sign and stamp the final report. You’ll receive a scanned copy instantly and a hardcopy delivered to your doorstep via courier. We proudly serve clients across India.

Property Valuation for Capital Gain & Bank Loan

Need to sell or apply for a loan? A property valuation report helps in both:

For Capital Gain Tax, it shows the property’s old value (e.g., as of 01.04.2001) to calculate your tax correctly.

For Bank Loans, it confirms the current market value, helping banks decide your loan amount.

Our Chartered Engineer-certified reports are valid for both tax filing and loan approvals across India.

Certified Property Valuation Consultant in Your Area

Legal Raja is your reliable partner for certified Property Valuation Consultant in Ahmedabad, serving clients across Gujarat and India. Whether it’s for Capital Gain Tax, Visa applications, Bank loans, or financial reporting, our valuation reports are prepared and signed by licensed Chartered Engineers, ensuring legal validity and accuracy.

Our reports are accepted by banks, embassies, tax departments, and auditors.

Contact Legal Raja: 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving All India

FAQs on Property Valuation: All You Need to Know

What is a Property Valuation Report?

A property valuation report is a certified document that states the estimated market value of a property, prepared by a qualified professional like a Chartered Engineer or Valuer.

Why is property valuation required?

It is required for purposes like bank loans, visa applications, capital gain tax calculation, insurance, accounting, audits, and property sale or purchase.

Who can issue a valid property valuation report?

Only a registered Chartered Engineer, Government-approved Valuer, or RERA-certified professional can issue an official valuation report.

How long does it take to get a report?

Usually, 2–4 working days. Draft is shared for review before final report is signed and sealed.