PF Return Filing Services in Ahmedabad

Are you searching for a reliable consultant for PF Return Filing Services in Ahmedabad? We provide professional and hassle-free solutions for EPF compliance, including registration, employee data management, and timely monthly return filing. Our expert team ensures your business meets all EPFO requirements smoothly and avoids any penalties.

Looking for PF Consultant in Ahmedabad? Call Now!

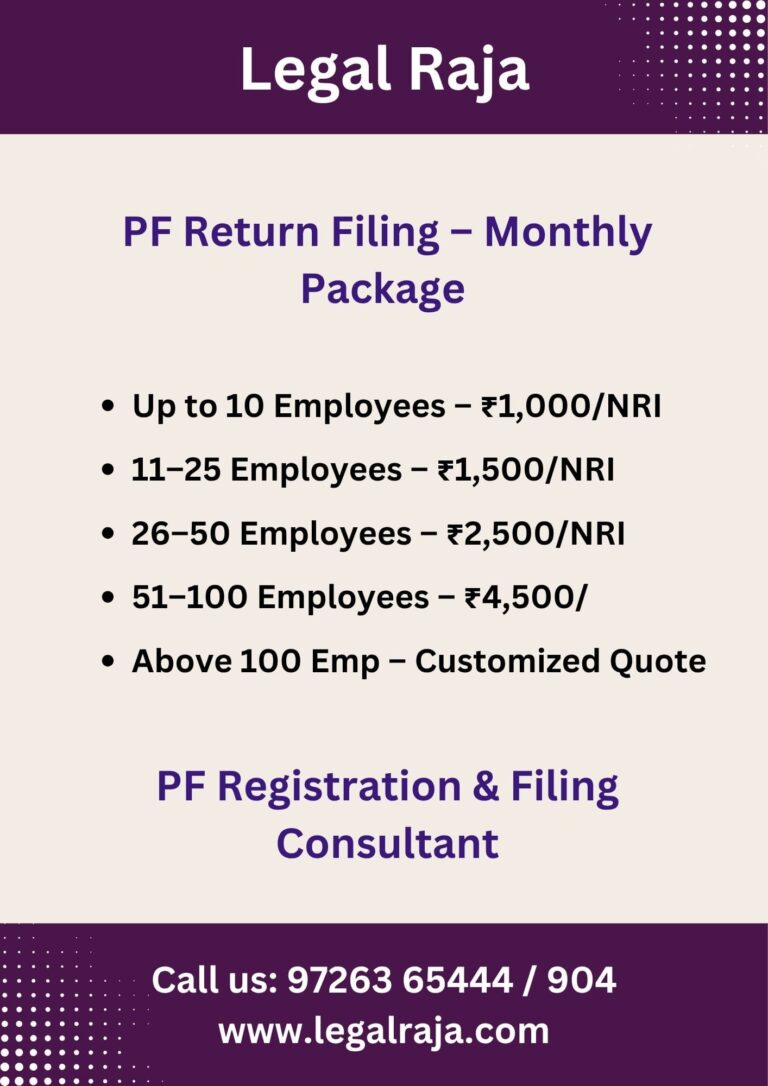

- Up to 10 Emp – ₹1,000/month

- 11–25 Emp – ₹1,500/month

- 26–50 Emp– ₹2,500/month

- 51–100 Emp – ₹4,500/month

- 100+ Emp – Custom Quote

📍 Monthly PF Compliance | ECR Filing | Expert Support | Ahmedabad Based Service

Understanding PF Return Filing Requirements

PF return filing is a mandatory process for businesses in Ahmedabad registered with the Employees’ Provident Fund Organisation (EPFO). It involves submitting monthly and annual reports detailing employee and employer PF contributions, typically through the EPFO’s online portal using the Electronic Challan cum Return (ECR). Employers must deduct 12% of an employee’s basic salary, match it with their contribution, and deposit it by the 15th of the next month. Accurate record-keeping, timely submissions, and compliance with EPFO rules are crucial to avoid penalties. Professional PF return filing services in Ahmedabad simplify this process, ensuring error-free filings, timely compliance, and proper management of employee data, saving businesses time and effort.

Connect with us today to simplify your PF return filing process in Ahmedabad and ensure 100% compliance with EPFO regulations.

PF Return Filing Charges in Ahmedabad – Affordable Plans

| Employee Count | Monthly Charges | Services Included |

|---|---|---|

| Up to 10 Employees | ₹1,000/month | Monthly PF Return (ECR), Challan, Employee UAN Update |

| 11–25 Employees | ₹1,500/month | All Above + PF Passbook Update, KYC Support |

| 26–50 Employees | ₹2,500/month | All Above + Employee Joining/Exit Formalities |

| 51–100 Employees | ₹4,500/month | Full EPF Compliance Management |

| Above 100 Employees | Customized Quote | Dedicated Account Manager, Audit Support, Full EPF Services |

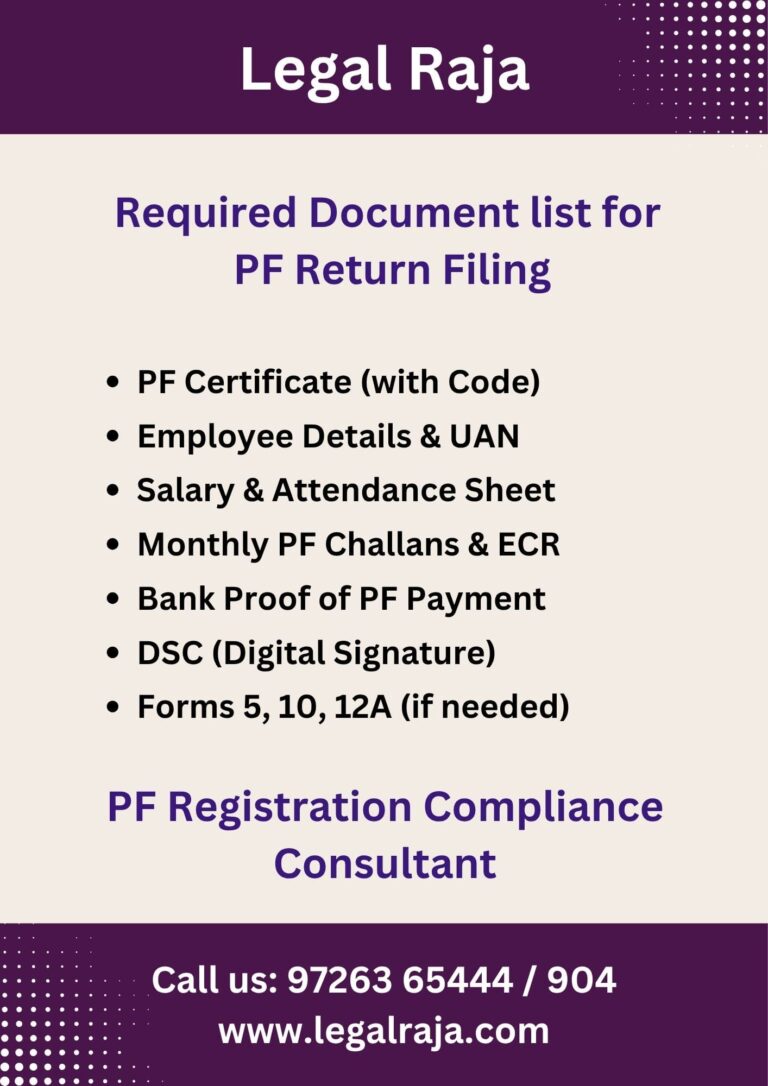

Documents Required for PF Return Filing in Ahmedabad

To file PF returns accurately and on time, businesses in Ahmedabad must keep the following documents ready:

PF Registration Certificate (with PF Code)

Employee Details with UAN

Salary & Attendance Records

Monthly PF Challans & ECR File

Bank Proof of PF Payment

Digital Signature (DSC)

Forms 5, 10, 12A (if applicable)

✅ Keep these documents ready to ensure smooth and timely PF return filing in Ahmedabad.

Key Benefits of Outsourcing PF Return Filing in Ahmedabad

Outsourcing PF Return Filing Services in Ahmedabad makes it easy to follow Employees’ Provident Fund Organisation (EPFO) rules. Here are the benefits in simple words:

- Saves Time: Experts do all the work, like filling forms and calculations, so you can focus on your business.

- No Mistakes: They get employee details and filings right, avoiding fines.

- On-Time Filing: They submit by the 15th of every month, so you don’t pay penalties.

- Easy Rules: They handle confusing EPFO rules and the online portal for you.

- Saves Money: Cheaper than hiring a full-time team for PF work.

- Helps Employees: They answer employee questions and keep PF records correct.

- Covers ESIC: Many also manage ESIC filings, handling everything in one go.

Due Dates for PF Return Filing You Need to Know

PF return filing is key for businesses in Ahmedabad to follow EPFO rules. Meeting due dates avoids fines and keeps employee savings safe. Here are the main due dates in simple words:

- Monthly Deposits: Pay employee and employer PF (12% each) by the 15th of next month (e.g., May 2025 due by June 15, 2025).

- Monthly ECR: Submit PF details (ECR) by the 15th of next month.

- Annual Returns: File Forms 3A and 6A by April 30 next year (e.g., 2024-25 due by April 30, 2025).

- New Employees: Add details (UAN, Aadhaar) in the same month they join.

Why It Matters: Late filings mean 12% interest or fines.

Expert Help: Ahmedabad services handle all filings on time, error-free. Connect with us for easy PF and ESIC filing.

Simple Steps to Get PF Filing Support in Ahmedabad

Send us all necessary documents, including employee details, salary records, and PF registration info to initiate the PF return filing process.

Our experts will prepare the PF return based on your data. You’ll receive a draft copy to review and confirm all details before submission.

Once approved, we will submit your PF return through the EPFO portal, ensuring timely and accurate compliance.

Avoid Penalties with Accurate and On-Time PF Return Filing Services

Timely and accurate PF return filing is crucial to avoid penalties, interest, and legal notices from the EPFO. Even a small delay or mistake in submission can lead to financial losses and compliance issues for your business. Our expert PF return filing services in Ahmedabad ensure that your monthly filings are completed correctly and within the deadline. We handle everything—from challan generation to ECR upload—so you never miss a due date. With professional support, you stay compliant, stress-free, and penalty-free.

Nearby PF Consultant for Return Filing & Registration

Legal Raja is your trusted PF Return Filing Services in Ahmedabad, offering expert compliance support to businesses across Gujarat and India. We provide end-to-end PF return filing services that include registration under EPFO, monthly ECR filing, challan generation, UAN activation, and employee record maintenance. Whether you’re a startup, SME, or established company, our team of Chartered Accountants and PF compliance specialists ensures your filings are accurate, timely, and fully compliant with EPFO norms.

From PF registration to monthly returns and audit assistance, Legal Raja takes care of everything under one roof—helping you avoid penalties and stay stress-free.

Contact Legal Raja: 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving Clients Across India

Frequently Asked Questions (FAQs)

What is PF return filing?

PF return filing is the monthly process of submitting employee and employer contribution details to the EPFO using the Electronic Challan cum Return (ECR) system.

Who needs to file PF returns?

All businesses registered under EPFO and having 20 or more employees (or as applicable) must file PF returns every month.

What is the due date for PF return filing?

The PF return must be filed by the 15th of every month for the previous month’s contributions.

What happens if PF returns are not filed on time?

Late filing attracts penalties, interest, and possible legal notices from EPFO.

Can I correct errors in PF return after filing?

Yes, corrections can be made through EPFO’s online grievance system or by contacting the local EPFO office.