PF Registration Consultant Near you

Looking to register your business under Provident Fund (PF)? Our expert PF Registration Consultant Near you. provide end-to-end support for EPF registration, documentation, and compliance. Whether you are a startup, small business, or large enterprise, we help ensure smooth registration under the Employees’ Provident Fund Organisation (EPFO), saving you time and avoiding penalties. Get professional assistance and stay fully compliant with all PF rules and regulations.

Get Expert PF Registration Services Today!

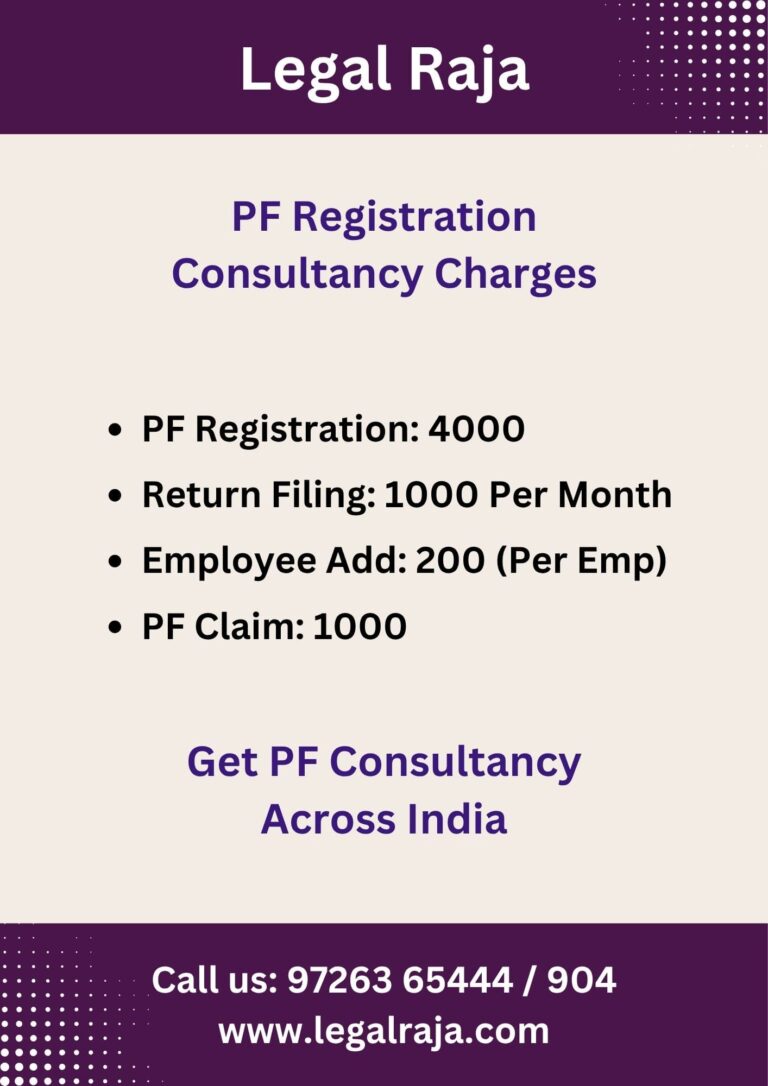

- PF Registration : ₹4,000

- Monthly PF Return Filing: ₹1,000

- Employee Enrollment: ₹200/employee

- PF Claim Assistance: ₹1,000/claim

📍 For Startups, SMEs, and Corporates | Ahmedabad Service | 100% Online Process

EPF Code Registration for Establishments

EPF Code Registration is a mandatory process for employers who are required to contribute to the Employees’ Provident Fund (EPF) under the EPFO regulations. Any business employing 20 or more employees must register for an Establishment EPF Code. This unique code is issued by the Employees’ Provident Fund Organisation (EPFO) and is used to manage employee contributions, employer deposits, and compliance filings.

As a PF Registration Consultant Near You, we provide complete assistance for EPF Code Registration – from preparing documents and filing the online application to coordinating with the EPFO office. We ensure fast, error-free registration so your business remains compliant, and your employees benefit from EPF features like retirement savings, pension, and insurance.

PF Registration & Compliance Charges in Ahmedabad

We provide complete PF consultancy support for businesses, covering everything from registration to ongoing compliance. As your trusted PF Registration Consultant Near You, we ensure that the entire process is handled professionally and efficiently. Here’s a quick breakdown of our charges:

PF Registration for Company – ₹4,000 (One-time setup)

Monthly PF Return Filing – ₹1,000 per month

Employee Enrollment – ₹200 per employee (One-time cost)

Employee PF Claim Assistance – ₹1,000 per claim

Whether you’re starting fresh or need ongoing support, we ensure a smooth and compliant PF process for your business and employees.

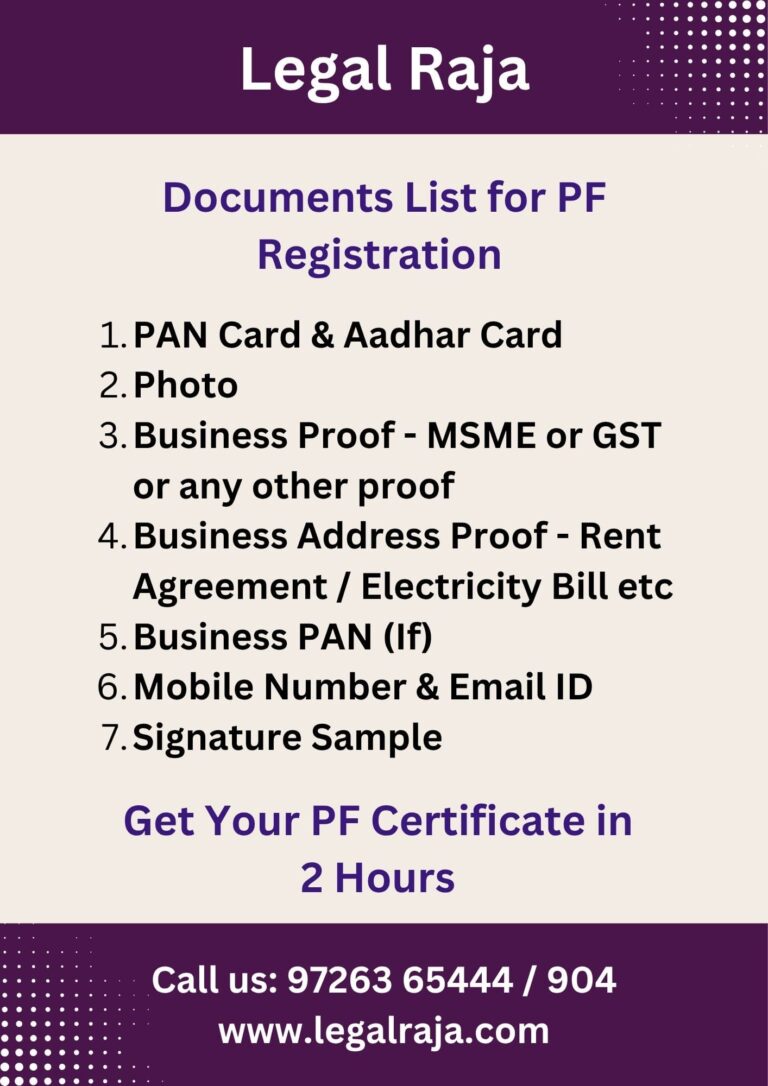

What Documents Are Required for EPF Registration?

To register your business for PF (EPF) under the EPFO, the following documents are mandatory. As a trusted PF Registration Consultant Near You, we help you prepare and submit all required documents accurately and efficiently:

- Owner’s PAN Card

- Owner’s Aadhar Card

- Passport-size Photograph

- Business Proof (MSME, GST, Shop License, etc.)

- Employee List with details

- Business Address Proof (Rent Agreement, Electricity Bill, or Tax Bill)

- Business PAN (if applicable)

- Mobile Number & Email ID

- Signature Sample of Owner/Authorized Signatory

PF Applicability Rules for Companies & Establishments

Provident Fund (PF) registration is mandatory for:

Companies or firms with 20 or more employees – Must get a PF Code from EPFO.

Factories listed in Schedule I of the PF Act – Compulsory PF registration.

Any other businesses notified by the Central Government – Must follow PF rules.

Voluntary PF Registration:

Businesses with fewer than 20 employees can still apply for PF registration voluntarily.

PF Registration is often required for government tenders, even if not otherwise mandatory.

We help both mandatory and voluntary cases with complete PF registration and compliance support.

Understanding PF Contribution & Deduction Rules for Employers

Under EPF rules, both the employer and employee contribute 12% of the employee’s basic salary + DA (Dearness Allowance) every month.

Employee’s Share: 12% is deducted directly from the employee’s salary.

Employer’s Share: 12% is also paid by the employer, out of which:

8.33% goes to the Pension Scheme

3.67% goes to the Provident Fund

Additional small contributions like EDLI (0.5%), Admin Charges (0.5%) may also apply.

As a dedicated PF Registration Consultant Near You, we help ensure all contributions are calculated correctly, deposited on time, and monthly returns are filed accurately—keeping your business fully compliant and penalty-free.

PF Code Registration in 30 Minutes – Start Your Process Today

Our experts will explain the PF rules, compliance requirements, documents needed, and service charges—so you’re clear before we begin.

Once you’re ready, just send us the required documents for PF registration. We’ll check and prepare everything for submission.

We’ll file your application on the EPF portal immediately. You’ll receive your official PF Registration Code and Certificate within 30 minutes—quick and hassle-free!

PF Compliance Requirements After Getting EPF Code

Once you receive your EPF (Provident Fund) Code, your business must follow regular compliance rules to avoid penalties and stay legally updated. As a trusted PF Registration Consultant Near You, we guide and support you through every step of ongoing compliance:

Monthly PF Return Filing – File ECR (Electronic Challan cum Return) every month on the EPFO portal.

Deposit PF Contributions – Both employer and employee shares must be deposited by the 15th of each month.

Employee Enrollment – Add new employees to the EPFO system as they join.

UAN Activation – Ensure all employees activate their Universal Account Numbers.

Maintain Records – Keep proper payroll and PF-related documents for audit and inspection.

Timely Updates – Inform EPFO about employee exits, salary changes, or other updates.

We offer full support for ongoing PF compliance to keep your business stress-free and fully compliant.

PF Registration Made Easy with Local Consultants

Legal Raja is your reliable partner for Provident Fund (PF) Registration in Ahmedabad, offering expert consultancy for businesses across Gujarat and India. As a trusted PF Registration Consultant Near You, we provide a complete EPF Registration Package that includes everything – employer registration, document preparation, employee enrollment, and ECR return filing support.

From getting your EPF Code within 30 minutes to managing ongoing compliance, our team of professionals ensures your business remains fully compliant with the Employees’ Provident Fund Organisation (EPFO) regulations. We serve startups, SMEs, and large enterprises with personalized and affordable PF solutions – all under one roof.

Contact Legal Raja: 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving All India

Frequently Asked Questions About PF Registration

Who needs to register for PF?

Any business with 20 or more employees must register under EPFO. Voluntary registration is also allowed for firms with fewer employees.

What is a PF Code?

A PF Code is a unique identification number allotted to a registered establishment by the Employees’ Provident Fund Organisation (EPFO).

How long does it take to get a PF Registration Code?

With proper documents, you can get your PF Code within 30 minutes through our fast-track registration service.

What documents are required for PF registration?

Basic documents include PAN, Aadhar, business proof, employee list, address proof, mobile, email, and signature sample.

Is it mandatory to file monthly PF returns after registration?

Yes, after registration, employers must file monthly ECR returns and deposit contributions before the 15th of each month.