LLP Annual Compliance Consultant in Ahmedabad

Legal Raja provides expert LLP Annual Compliance Consultant in Ahmedabad, including Form 11, Form 8, ITR filing, and audit support. Our CA team ensures timely and accurate filings to keep your LLP fully compliant and penalty-free.

Make LLP Compliance Effortless with Our Help

LLP Annual Filing Package

- ROC Filing (Form 8 & 11) for FY

- Form 11 (Annual Return of LLP)

- DIN KYC

- Income Tax Return Filing for LLP

- Form ITR-5 submission

- Audit (If Applicable)

🎯 Affordable Pricing | CA/CS Expert Support | Timely Filing Guaranteed

Understanding Annual Compliance for LLPs

Limited Liability Partnerships (LLPs) offer the advantage of limited liability with minimal compliance compared to companies, but they are still bound by essential annual legal obligations. Every LLP registered in India must file two major ROC forms annually—Form 11, which is the Annual Return, and Form 8, which is the Statement of Accounts and Solvency. Form 11 is due by 30th May and captures details of the partners and any structural changes within the LLP during the financial year. Form 8, due by 30th October, provides financial details, including profit and loss and a declaration on the solvency status of the LLP.

Along with ROC filings, LLPs are also required to file their Income Tax Return (ITR) annually. If the turnover exceeds ₹40 lakhs or the capital contribution goes beyond ₹25 lakhs, the LLP must undergo a mandatory audit of its books by a Chartered Accountant. Failure to meet these compliance deadlines can result in a penalty of ₹100 per day per form, with no upper limit.

Proper maintenance of financial records, timely filings, and adherence to compliance norms not only help avoid legal penalties but also improve the LLP’s credibility in the eyes of clients, banks, and regulatory bodies. If you’re looking for expert assistance, our LLP Annual Compliance Consultant in Ahmedabad provides end-to-end support—from document preparation to final submission—ensuring your LLP stays fully compliant and penalty-free. For growing businesses, staying compliant is a smart strategy for long-term sustainability and financial discipline.

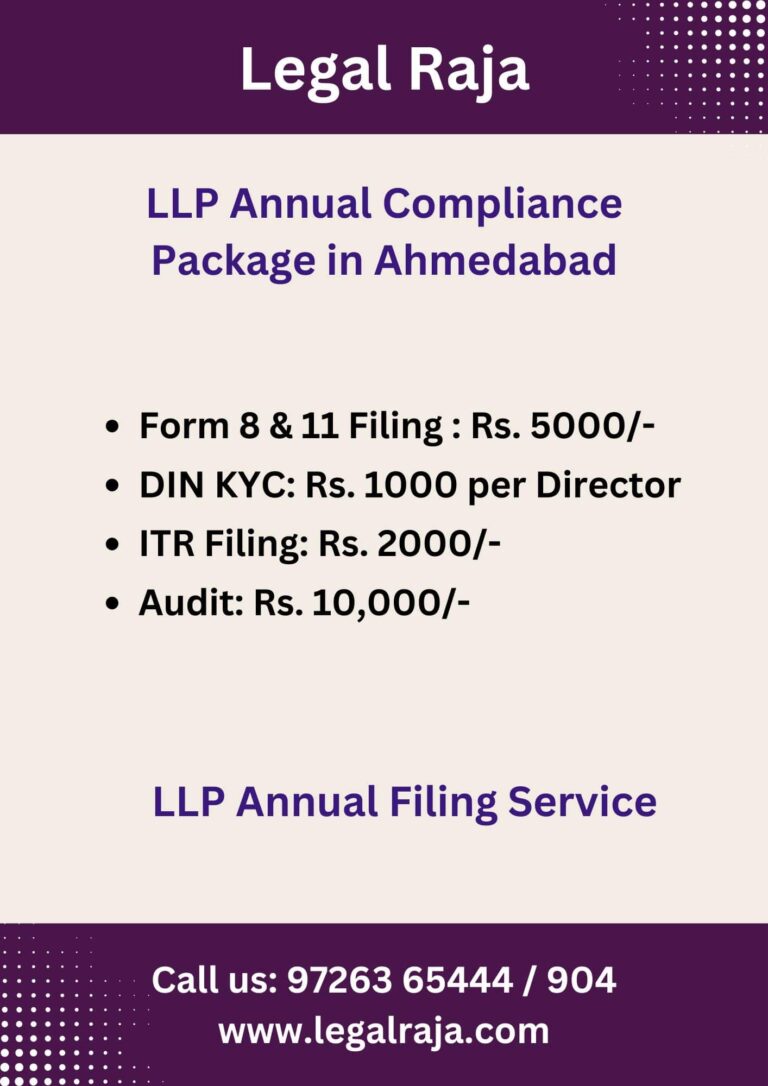

Cost of LLP Annual Returns Filing in Ahmedabad

LLP Annual Compliance Consultant in Ahmedabad – Transparent Pricing & Pan-India Services

Looking for a reliable LLP Compliance Consultant near you? We proudly serve clients not just in Ahmedabad but across India, offering end-to-end compliance support for Limited Liability Partnerships. Our pricing is straightforward, affordable, and tailored for startups, professionals, and growing businesses.

ROC Annual Filing (Form 8 & Form 11): ₹5,000/-

Covers preparation and submission of both mandatory ROC forms to ensure legal compliance.DIN KYC Filing: ₹1,000/- per Director

Mandatory KYC filing for each designated partner to keep their DIN active.Income Tax Return (ITR) Filing: ₹2,000/-

Includes computation and filing of LLP income tax returns with accuracy and compliance.Audit (If Applicable): ₹10,000/-

Required for LLPs with turnover above ₹40 lakhs or contribution above ₹25 lakhs, conducted by qualified Chartered Accountants.

With professional guidance, timely filings, and dedicated support, we make compliance hassle-free. Whether you’re in Ahmedabad or anywhere else in India, our expert team ensures your LLP remains fully compliant and penalty-free.

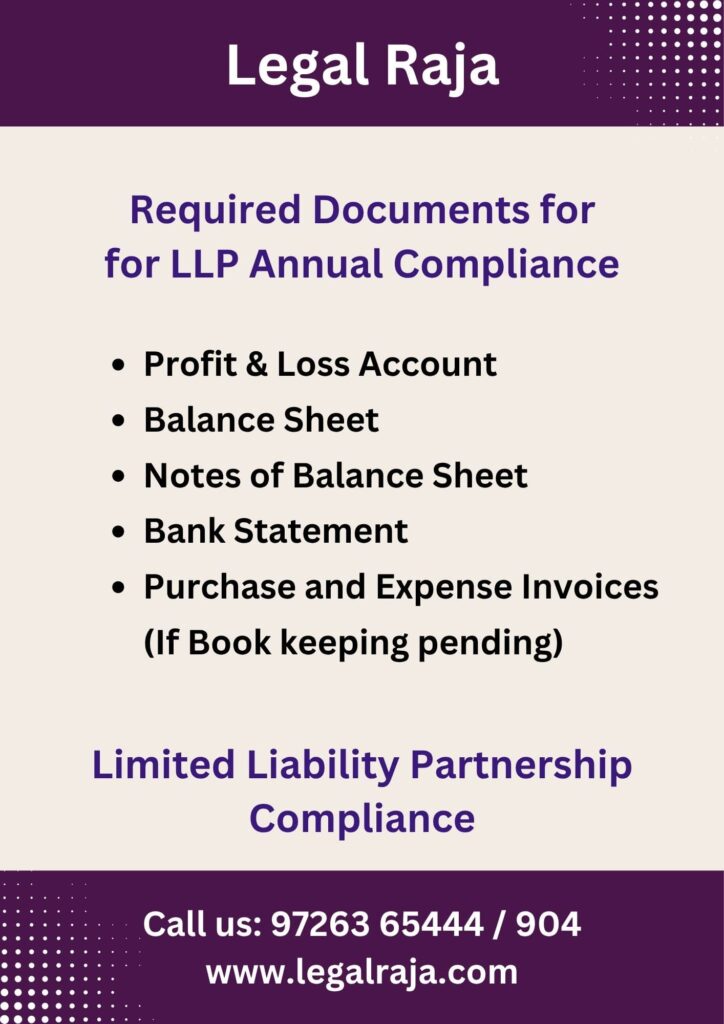

Documents Checklist for LLP Annual Return Filing

LLP Annual Compliance Consultant in Ahmedabad – Document Checklist Made Simple :-

Profit and Loss Account

Balance Sheet

Notes to Accounts (Balance Sheet Notes)

Bank Statement (for the entire financial year)

Sales Invoices (if bookkeeping is pending)

Purchase Invoices (if bookkeeping is pending)

Expense Invoices/Bills (if bookkeeping is pending)

Details of Partners (if any change during the year)

Previous Year’s ITR Copy (if applicable)

Digital Signature (DSC) of Designated Partners

Important ROC Filing Due Dates for LLPs in Ahmedabad

If you run an LLP, staying on top of annual compliance is essential to avoid penalties and maintain your legal status. As your trusted LLP Annual Compliance Consultant in Ahmedabad, we help you stay updated with all mandatory filings. Here’s a quick guide to the most important forms and their due dates:

Stay compliant with these essential LLP filings:

Form-11 (Annual Return) – Due by 30th May

Form-8 (Accounts & Solvency) – Due by 30th October

ITR Filing – Due by 31st July

DIN KYC – Due by 30th June

We help LLPs in Ahmedabad and across India file on time, avoid penalties, and stay legally compliant.

LLP Audit Criteria & Limits for Firms in Ahmedabad

If you’re running a Limited Liability Partnership in Ahmedabad, it’s important to know when a statutory audit becomes mandatory. As per the LLP Act, an audit is required only if:

The annual turnover exceeds ₹40 lakhs, or

The capital contribution exceeds ₹25 lakhs

If your LLP crosses either of these thresholds in a financial year, a statutory audit by a Chartered Accountant becomes compulsory. The audit ensures your books of accounts are accurate and compliant with legal standards. LLPs below these limits are exempt from audit but must still maintain proper financial records.

We help Ahmedabad-based LLPs assess audit applicability, get their accounts audited, and complete ROC and tax filings on time—ensuring full compliance and peace of mind.

Step-by-Step Process to Get LLP Annual Filing Done

Just share the required documents—our team will guide and coordinate with you throughout the process.

Our experienced Chartered Accountants will prepare Form 8, Form 11, and ITR. Every return is thoroughly reviewed by our CA team to ensure accuracy and compliance.

Once approved, we’ll file the ROC forms and share the acknowledgment, filed forms, and challans directly to your email for recordkeeping.

Is Income Tax Audit Mandatory for Your LLP?

Whether an LLP requires an Income Tax Audit depends on its type of business and turnover. As per the Income Tax Act:

Professionals: Gross receipts exceed ₹50 lakhs

Businesses: Turnover exceeds ₹1 crore

Under Section 44AD/44ADA, audit is also required if:

Profit is less than 6% or 8% of turnover (for businesses)

Profit is less than 50% of receipts (for professionals)

Find the Best LLP Compliance Consultant Near You

Need help with LLP Annual Compliance in Ahmedabad? Legal Raja offers complete compliance services including Form 11, Form 8, DIN KYC, and ITR filing. We also handle audit support if required. Our expert CA and CS team ensures timely and hassle-free filing, keeping your LLP compliant and penalty-free.

- Contact Legal Raja: 9726365444

- Email: office@legalraja.com

- Head Office: Ahmedabad, Gujarat – Serving All India

FAQ's on LLP Annual Compliance

What is LLP Annual Compliance?

LLP Annual Compliance includes mandatory filings like Form 11 (Annual Return), Form 8 (Statement of Accounts), Income Tax Return, and DIN KYC

Is compliance mandatory even if LLP has no business?

Yes, compliance is mandatory even for NIL turnover LLPs to avoid penalties.

What is the penalty for late filing?

₹100 per day per form, with no maximum limit.

When is audit required for an LLP?

If turnover exceeds ₹40 lakhs or capital contribution exceeds ₹25 lakhs.