HUF Registration Consultant in Ahmedabad

Looking to create a Hindu Undivided Family (HUF) for tax saving or family business purposes? We help you HUF Registration Consultant in Ahmedabad quickly and legally. Our service includes preparing the HUF deed, applying for a PAN card, and guiding you with the required documents. With expert support and a simple process, we make HUF formation easy and stress-free for you.

Start Your HUF with Professional Support

HUF Registration Package

- HUF Deed

- PAN Card of HUF

- Bank Account

Rs. 3,000/-

📍 Quick, Legal & Tax-Friendly | Ideal for Family Income Planning | Expert Support

Key Rules for Forming a Hindu Undivided Family (HUF)

A Hindu Undivided Family (HUF) is a legal entity formed by members of a Hindu family to hold and manage ancestral assets collectively and enjoy tax benefits under Indian law. It is governed by Hindu Law and recognized under the Income Tax Act. Only Hindus, Jains, Sikhs, and Buddhists can form an HUF. The senior-most family member becomes the Karta, who manages the affairs of the HUF on behalf of all members (called coparceners).

To officially register an HUF, a formal HUF Deed must be drafted, declaring the name of the HUF, details of the Karta and members, and the intention to form the HUF. A separate PAN card is required in the name of the HUF, and a dedicated bank account must be opened for HUF-related transactions. The income earned by the HUF—such as rental income, interest, capital gains, or returns on ancestral assets—is taxed separately from the individual members, making it a smart choice for tax planning.

If you’re in Ahmedabad and planning to form an HUF, Legal Raja is your trusted HUF Registration Consultant in Ahmedabad. We help with deed drafting, PAN application, bank setup, and document guidance—ensuring a quick and legally compliant HUF setup with complete expert support.

Affordable HUF Formation Services in Ahmedabad

HUF Creation Package – Just ₹3000 Only

Start your Hindu Undivided Family (HUF) smoothly with our expert service. This special package is designed to help you form your HUF legally and quickly—perfect for tax planning and managing family income.

What’s Included:

✅ HUF Deed – A legal paper that declares your HUF and its members

✅ PAN Card – Separate PAN for the HUF to file taxes

✅ Bank Account – Support to open a bank account in HUF’s name

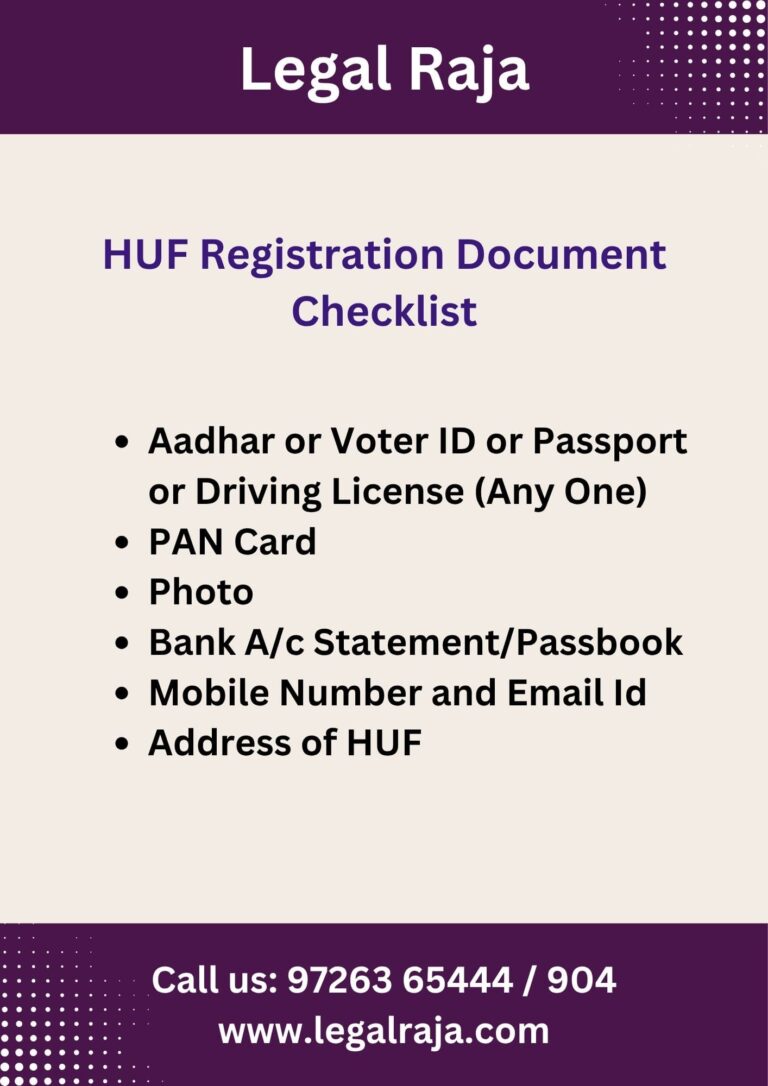

Documents Required for HUF Formation in Ahmedabad

Key Advantages of Registering a Hindu Undivided Family (HUF)

Tax Saving – Income of HUF is taxed separately, reducing the overall tax burden of the family.

Separate PAN & Bank Account – HUF gets its own identity for financial transactions and tax filing.

Ideal for Joint Family Assets – Income from ancestral property or investments can be managed under HUF.

Simple Formation Process – Easy setup with minimal documents and one-time registration.

Better Wealth Management – Helps in structured handling of family income and long-term financial planning.

Who Can Register a Hindu Undivided Family (HUF)?

Thinking of starting an HUF? It’s easier than you think—just tick these 3 boxes:

- Be from the Right Roots

Your family must belong to the Hindu, Jain, Sikh, or Buddhist community. That’s the cultural foundation of every HUF. - Start a Family

You either need to be married or have children. One of these is enough to give your HUF a legal start. - Have Family Assets

Whether it’s ancestral property, savings, or income sources—your family must have assets to manage under the HUF.

If you meet these three simple conditions, you’re ready to form your own Hindu Undivided Family—and Legal Raja is here to help make it official!

Step-by-Step Registration Process

Our team will get in touch with you to collect the required documents and prepare the draft of your HUF Deed – the legal start of your Hindu Undivided Family.

The Karta and family members will review and sign the deed. Once done, it’s stamped and becomes your official family document.

We’ll take care of everything – HUF registration, PAN card, and bank account setup. Need help with HUF-related compliance later? We’re here for that too!

Ongoing Compliance for HUF Entities in Ahmedabad

HUF Registration Consultant in Ahmedabad

Forming a Hindu Undivided Family (HUF) is simple, and so is its compliance. You only need to file an Income Tax Return if the HUF’s income exceeds ₹2.5 lakh in a year. No income? No filing needed.

Legal Raja makes HUF registration and compliance easy, quick, and hassle-free in Ahmedabad!

HUF Registration Services Near You – Quick & Trusted

Starting a Hindu Undivided Family (HUF)? Legal Raja is your trusted HUF Registration Consultant in Ahmedabad, guiding families across Gujarat and India. We offer a complete HUF Formation Package that includes deed drafting, PAN card application, and assistance in opening a bank account – everything under one roof.

Whether it’s for tax saving, managing joint family income, or setting up ancestral investments legally, our expert team of Chartered Accountants and legal professionals makes HUF creation smooth, valid, and hassle-free.

Contact Legal Raja: 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving All India

FAQs on Hindu Undivided Family (HUF) Registration

What is an HUF?

An HUF (Hindu Undivided Family) is a separate legal entity formed by a Hindu family to manage joint income and assets, especially for tax-saving purposes.

Who can create an HUF?

Only Hindu, Jain, Sikh, or Buddhist families can form an HUF. The family must have at least two members – a Karta (head) and another coparcener (like a spouse or child).

What documents are needed for HUF formation?

You need Aadhar cards, PAN cards, photos of members, marriage or birth date, and contact details of the Karta.

What is included in HUF registration?

HUF Deed drafting, PAN card application, and help with opening a bank account in the HUF’s name.

Is income tax filing required for HUF?

Yes, if the HUF earns more than ₹2.5 lakh annually, it must file an income tax return separately.