GST Return Filing Consultant Near You

Looking for a GST Return Filing Consultant Near You? Whether you’re a business owner, freelancer, or startup, timely and accurate GST return filing is essential to avoid penalties and stay compliant. Our expert consultants handle monthly, quarterly, and annual GST filings, ensuring your taxes are filed correctly and on time—so you can focus on running your business.

Need Help with GST Return Filing? Talk to an Expert Today

GST Return Package

- Monthly Filing - From ₹1,500

- Composition Scheme- ₹2,000

- Annual Return – ₹5,000

- GST Audit – ₹10,000

- GST Refund - ₹10,000/Claim

- GST Reconciliation

📍 Ahmedabad-Based Experts | PAN India Support | Timely & Compliant Filing

Simplify Your Taxes with Expert GST Return Filing

GST return filing is a mandatory responsibility for every registered business under the Goods and Services Tax law, even if there is no turnover in a particular month. Businesses in Ahmedabad often face challenges due to multiple tax rates, different HSN/SAC codes, exempt or nil-rated goods, and interstate transactions. Returns like GSTR-1 (for sales invoice upload) and GSTR-3B (for tax summary and payment) must be filed accurately every month. Annual compliance like GSTR-9 is required for businesses with turnover above ₹2 crore, and GSTR-9C for those above ₹5 crore.

Since the GST portal does not allow revisions after filing, errors can lead to penalties and notices. That’s why it’s important to have a GST Return Filing Consultant Near You who understands the complexities of compliance. At Legal Raja, based in Ahmedabad, our experienced GST consultants and Chartered Accountants handle all types of GST filings—regular, composition, and high-value returns. We ensure timely, accurate, and hassle-free compliance to keep your business safe and audit-ready.

GST Return Types & Their Due Dates – Complete Guide

GST Return Types & Due Dates – Simplified Guide

GST compliance involves timely filing of various returns based on your business type and turnover. Here’s a quick breakdown of the main return types and their deadlines:

Monthly Returns (Regular Taxpayers)

GSTR-1 – Report of outward sales (invoice-wise)

Due Date: 11th of every month

GSTR-3B – Summary of sales, purchases, and tax payment

Due Date: 20th of every month (Some states have 22nd or 24th for smaller taxpayers)

Quarterly Returns (Composition Scheme)

CMP-8 – Summary of sales & tax payment by composition dealers

Due: 18th of the month following the quarter

Annual GST Compliance

GSTR-9 – Annual return for regular taxpayers

GSTR-9C – Audit reconciliation (mandatory if turnover exceeds ₹5 Cr)

Due Date: 31st December of the following financial year

Other Returns (Special Category Taxpayers)

GST TDS / TCS – For entities required to deduct or collect tax

Input Service Distributor (ISD) – GSTR-6

Non-resident taxpayers – GSTR-5 / GSTR-5A

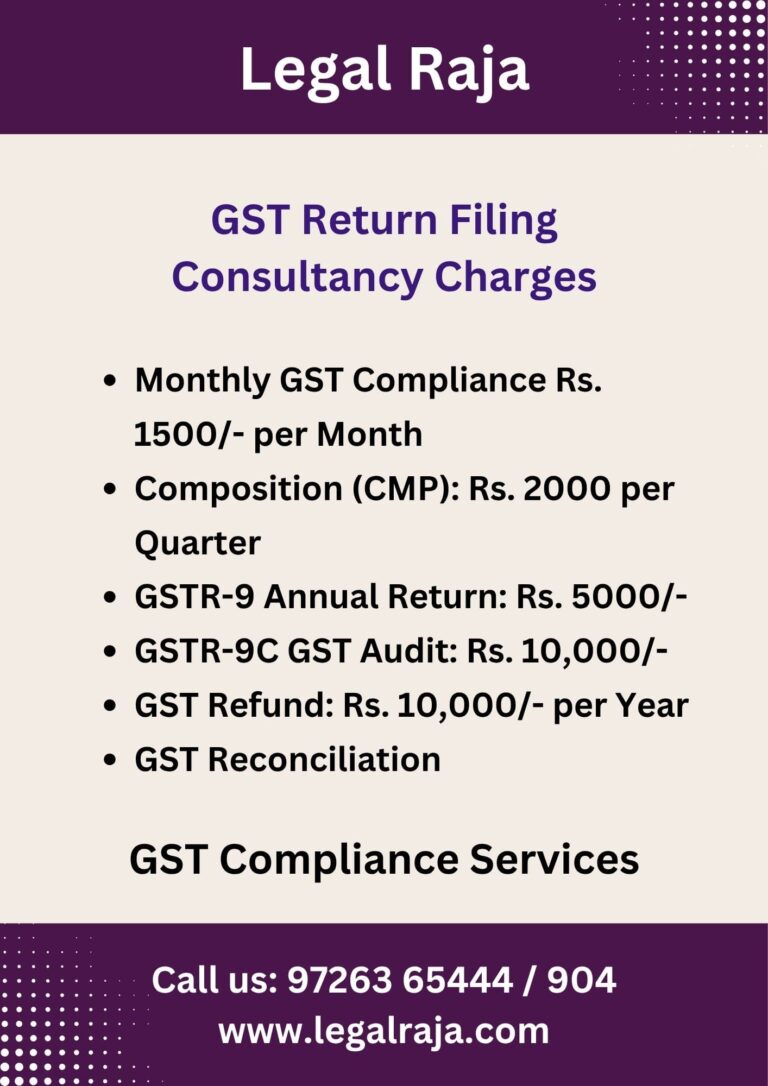

GST Consultant Fee Structure in Ahmedabad

Searching for a Reliable GST Return Filing Consultant Near You? At Legal Raja, we offer complete GST return filing and compliance support at affordable rates. Whether you’re a regular taxpayer or under the composition scheme, we’ve got the right plan tailored to your business needs.

Here’s a quick look at our service charges:

✅ Monthly GST Filing (GSTR-1 & GSTR-3B): Starting from ₹1,500/month

✅ Composition Scheme (CMP-08): ₹2,000 per quarter

✅ Annual GST Return (GSTR-9): ₹5,000

✅ GST Audit Filing (GSTR-9C): ₹10,000

✅ GST Refund Application: ₹10,000 per claim/year

✅ GST Reconciliation: Charges vary based on data volume

As your reliable GST Return Filing Consultant Near You, we ensure timely filing, accurate data entry, and full compliance—so you can focus on running your business while we take care of the tax work.

Based in Ahmedabad | Serving clients across Gujarat & India

Checklist of Documents Needed for GST Return Filing

Advantages of Choosing a GST Expert for Return Filing

Working with a GST expert doesn’t just ensure timely return filing—it brings a host of valuable benefits:

Accurate Records: Your GST data is filed correctly and systematically.

Reduced Errors: Avoid costly filing mistakes that can lead to penalties.

Process Improvements: Get smart advice to streamline your tax and accounting systems.

Save on Penalties & Taxes: Experts help optimize input claims and prevent overpayments.

Guidance on Complex Issues: Stay on top of tricky GST matters with professional insights.

Avoid Legal Notices: Minimize the risk of GST department queries or demands.

Transparent Compliance: Strengthen business governance with clean, audit-ready filings.

With a GST expert by your side, compliance becomes effortless—and your business stays safe, efficient, and future-ready.

GST Demand & Scrutiny Assistance in Ahmedabad

Avoid Penalties—File Your GST Returns on Time

Failing to file or incorrectly filing your GST returns can lead to penalties and legal trouble. As per GST law:

Late Filing Penalty: ₹50 per day, per return

Nil Return Penalty: ₹20 per day, per return (if there’s no turnover)

These charges can pile up quickly and affect your business compliance.

At Legal Raja, we help you stay penalty-free with timely return filing, accurate reconciliation, and expert support for handling GST demand notices and scrutiny cases. Whether you’re facing a mismatch or have received a notice from the GST department, our consultants in Ahmedabad are ready to assist you.

How to Register an LLP – Complete Process Explained

Reach out to our GST experts and we’ll first understand your business type and GST requirements. Based on this, we’ll share a customized checklist of documents that you’ll need to send us each month.

At the end of every month, simply send us the required documents and data as per the checklist. This helps us keep your filings accurate and up to date.

Our team of experienced GST professionals and Chartered Accountants will prepare and file your returns on time. You stay worry-free while we ensure 100% on-time compliance with GST rules.

Find Trusted GST Return Filing Consultants in Your Area

Legal Raja is your trusted GST Return Filing Consultant Near You, based in Ahmedabad and serving clients across Gujarat and India. We offer a complete GST Compliance Package, covering everything from monthly and quarterly return filing (GSTR-1, GSTR-3B) to annual returns (GSTR-9, GSTR-9C), reconciliation, and GST notice handling.

With a dedicated team of expert Chartered Accountants and GST professionals, we ensure your business stays compliant, avoids penalties, and files returns accurately and on time – every time.

Contact Legal Raja: 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving All India

Frequently Asked Questions on GST Return Filing

Who needs to file GST returns?

All registered GST taxpayers, including regular dealers, composition scheme holders, and input service distributors, must file GST returns as per their category.

What happens if I miss the due date?

Late filing attracts a penalty of ₹50/day (₹20/day for Nil returns), along with interest on outstanding tax.

Can GST be filed without any business activity?

Yes, Nil GST Returns must be filed even if there’s no sale or purchase in a month.

How can Legal Raja help with GST return filing?

At Legal Raja, we offer complete GST return filing services, including document preparation, accurate filing, reconciliation, and handling GST notices, ensuring timely compliance.