GST Registration Consultant in Ahmedabad

Looking for a GST Registration Consultant in Ahmedabad? GST registration is a mandatory compliance for businesses operating in Ahmedabad with a turnover above the prescribed limit or involved in inter-state supply. As experienced GST consultants, we offer end-to-end support for new GST registration, amendments, regular return filing, and overall compliance. Whether you are a startup, trader, manufacturer, or service provider, our team ensures a smooth and error-free GST registration process with complete documentation and timely updates.

Get GST Registered in Ahmedabad - Get Expert Help Today!

- Online Application Filing

- Department Follow-up

- Physical Verification Support

- Spot Verification Help

- GST Certificate Done

Rs. 3,000/-

📍 Expert Consultant in Ahmedabad | Fast & Hassle-Free GST Registration

Goods & Services Tax Registration – A Complete Guide

Whether you’re a startup, trader, or growing enterprise, Legal Raja offers complete GST registration support tailored to your business needs. As per GST law, registration is compulsory if your turnover exceeds ₹20 lakhs (services) or ₹40 lakhs (goods) in Gujarat. It’s also mandatory for interstate suppliers, e-commerce sellers, and casual taxable persons—regardless of turnover. Governed by the CGST and SGST Acts, GST applies to all types of supply—sales, transfers, leases, and services—and is crucial for legally running a business in Ahmedabad. Even if you don’t meet the turnover limit, voluntary GST registration lets you claim ITC, enhance business credibility, and build customer trust.

Looking for expert help? Contact Legal Raja – a reliable GST Registration Consultant in Ahmedabad – for hassle-free filing, documentation, and CA-backed guidance to get your GST number smoothly.

Do You Need GST Registration in Ahmedabad?

GST registration is mandatory for the following types of businesses or cases:

- Turnover above ₹20L (₹40L for goods)

- Exporters claiming GST refund (ITC)

- Selling on Amazon, Flipkart, etc.

- Paying GST under Reverse Charge (RCM)

- Input Credit Distributor (ICD/ISD)

- Selling outside Gujarat (Interstate)

- Want to pass ITC to clients/customers

If your business falls under any of the above categories, you must register under GST to stay compliant. Legal Raja, a leading GST Registration Consultant in Ahmedabad, provides complete support for filing, documentation, and expert guidance to help you obtain your GSTIN quickly and hassle-free.

Legal Raja Offers GST Registration @ ₹3000 in Ahmedabad

Our Consultancy GST registration package covers everything you need:

- Online GST application filing

- Follow-up with GST department

- Physical verification support (in select cities)

- Spot verification guidance across Ahmedabad

- Final GST registration certificate delivered

- Complete service at just ₹3000 by Legal Raja

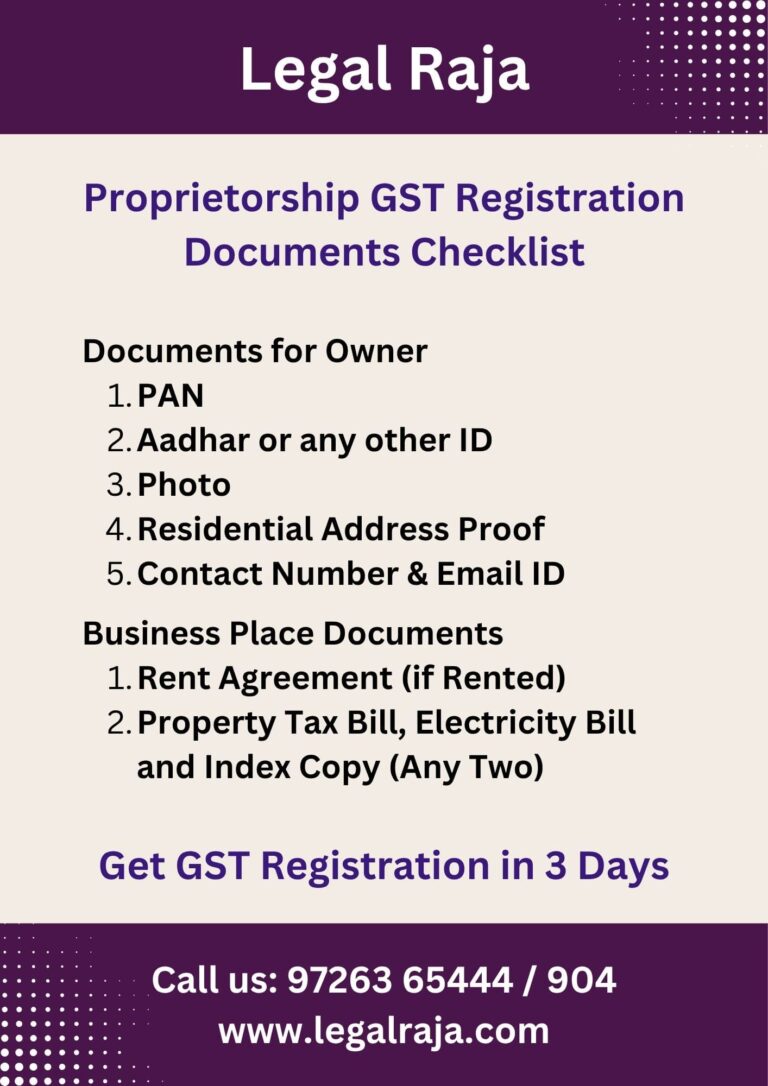

Checklist of Documents for GST Registration in Ahmedabad

To successfully register your business under GST in Ahmedabad, it’s essential to have all the required documents ready. The documentation may vary depending on your business type (proprietorship, partnership, company, etc.), but here’s a standard checklist to ensure a smooth registration process:

✅ Identity & Address Proof of Proprietor/Partners/Directors

– PAN Card

– Aadhar Card

– Passport-size Photo

– Voter ID or Passport (any one)

✅ Business Address Proof

– Electricity Bill / Property Tax Bill

– Rent Agreement (if rented)

– NOC from Owner (if applicable)

✅ Business Constitution Proof

– Partnership Deed / Incorporation Certificate / MoA & AoA (as applicable)

– PAN of the Business Entity

✅ Bank Details

– Cancelled Cheque or Bank Statement with Business Name

✅ Email ID and Mobile Number of Authorized Signatory (for OTP verification)

With Legal Raja, your trusted GST Registration Consultant in Ahmedabad, you get complete assistance from document preparation to final approval of your GSTIN.

GST Applicability Based on Annual Turnover

GST registration becomes mandatory when a business’s annual turnover exceeds prescribed limits set by the GST law. These limits vary depending on the type of supply and the state of operation:

- For Goods:

– ₹40 lakhs in most states

– ₹20 lakhs in special category states (like Himachal Pradesh, North-East) - For Services:

– ₹20 lakhs in most states

– ₹10 lakhs in special category states

Businesses below these limits can register voluntarily to claim Input Tax Credit (ITC) and enhance their business credibility. Special cases like e-commerce sellers and interstate suppliers require GST registration regardless of turnover.

If you’re unsure whether GST applies to your business, consult Legal Raja – a professional GST Registration Consultant in Ahmedabad – for expert advice and end-to-end assistance with documentation, filing, and compliance.

Understanding GST Liability with Example

GST liability refers to the amount a business owes to the government after adjusting output tax (collected from customers) against input tax (paid on purchases).

Example:

A business sells goods worth ₹1,00,000 and charges 18% GST → Output GST = ₹18,000

The same business purchased raw materials worth ₹50,000 and paid 18% GST → Input GST = ₹9,000

GST Payable (Liability) = Output GST – Input GST

= ₹18,000 – ₹9,000 = ₹9,000

This ₹9,000 must be paid to the government. If Input GST exceeds Output GST, the excess can be carried forward or claimed as a refund.

Quick GST Registration Services – 7-Day Process

Share the required documents like PAN, Aadhar, address proof, etc. so we can begin the registration process.

Our team files your GST application online. If needed, the GST officer may do a physical verification of your business location.

Once the department is satisfied with all the details, your GST registration will be approved and the GST Certificate will be issued.

GST Compliance After Registration – What You Must Do

Once your business is GST registered, you must follow these ongoing compliance steps to stay legal and avoid penalties:

✅ Keep Records – Maintain all purchase and sales bills.

✅ File GST Returns – Submit GSTR-1 and GSTR-3B monthly or quarterly.

✅ Do Yearly Filing – File annual return and audit (if turnover is high).

These steps help you stay GST-compliant and avoid penalties.

Find the Best GST Registration Expert Near You

Legal Raja is your trusted GST Registration Consultant in Ahmedabad, providing professional assistance to businesses across Gujarat and India. Our end-to-end GST registration package includes everything – document preparation, online filing, departmental follow-up, and guidance for spot verification (if applicable). Whether you’re a startup, trader, or service provider, our experienced team ensures you get your GSTIN quickly and compliantly.

Contact Legal Raja: 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving All India

FAQ's on Goods & Services Tax Registration

Who needs to register for GST?

Any business with turnover above ₹20 lakhs (services) or ₹40 lakhs (goods) must register. Also compulsory for interstate sellers, e-commerce, and exporters.

What documents are required for GST registration?

PAN, Aadhar, photo, business address proof, bank details, and business constitution proof (like partnership deed or company certificate).

How long does GST registration take?

Typically 5–7 working days, subject to document accuracy and department verification.

Can I register for GST voluntarily?

Yes. Even if you’re below the turnover limit, you can register to claim Input Tax Credit and boost business credibility.

What happens after GST registration?

You must file monthly/quarterly GST returns, maintain records, and comply with GST law.