F&O Tax Audit Consultant in Ahmedabad

If you are involved in Futures & Options (F&O) trading, it is essential to ensure proper tax compliance through a professional tax audit. At Legal Raja, we specialize in F&O Tax Audit Consultant in Ahmedabad, helping traders accurately calculate turnover, prepare audit reports, and file Income Tax Returns (ITR) as per Section 44AB of the Income Tax Act. Our team of expert Chartered Accountants (CAs) understands the complexities of derivative trading and offers tailored solutions to ensure you meet all legal requirements without hassle.

Need a CA for F&O Turnover Calculation and Audit?

- F&O Accounting

- Tax Audit Report (Sec 44AB)

- ITR-3 Filing

- DSC (Digital Signature)

Rs. 14,000/-

For Traders | CA-Assisted | Ahmedabad Service

Futures & Options (F&O) Tax Audit Guidelines

In Futures & Options (F&O) trading, tax compliance is crucial. At Legal Raja, your trusted F&O Tax Audit Consultant in Ahmedabad, we ensure accurate reporting and audit filing. As per the Income Tax Act, F&O income is treated as non-speculative business income and must be reported under the “Business & Profession” head in ITR-3.

A tax audit under Section 44AB is mandatory if turnover exceeds ₹10 crore, or if profit is less than 6% of turnover without opting for presumptive taxation (Sec 44AD). We help you maintain proper books (as per Sec 44AA), calculate turnover correctly, and file Form 3CA/3CB & 3CD with ITR. With our expert CA support, you stay fully compliant and avoid penalties—trust Legal Raja for fast and accurate F&O audit services in Ahmedabad.

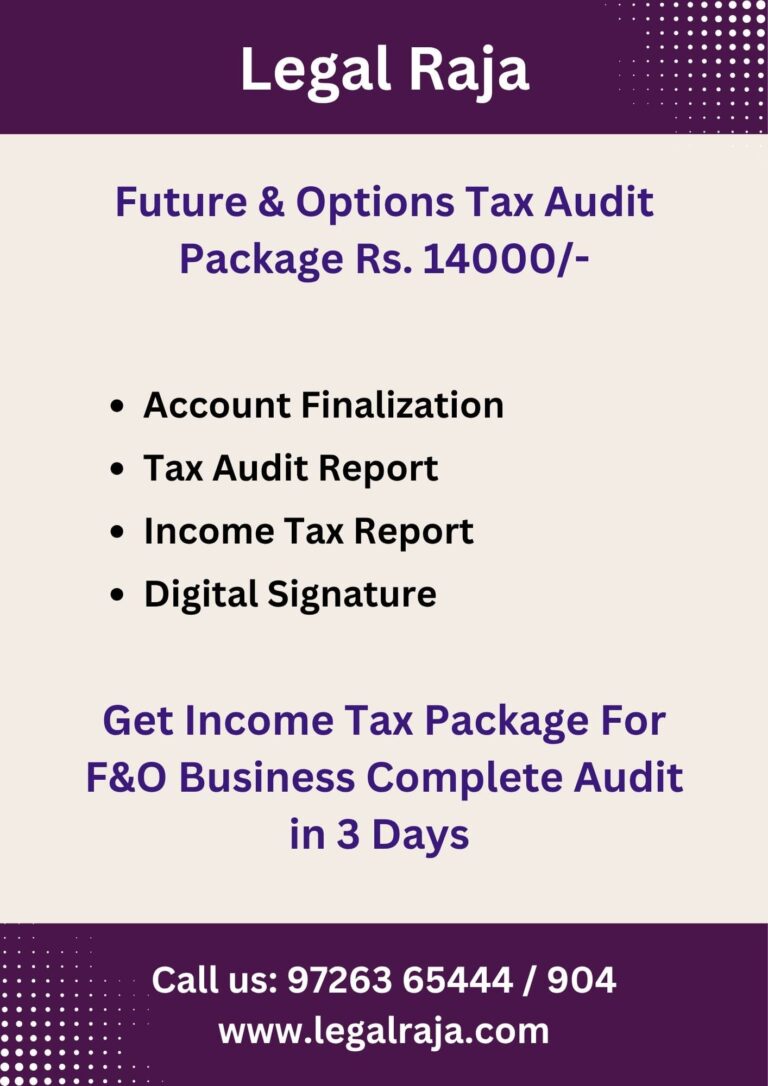

Futures & Options Tax Audit Fees in Ahmedabad

Looking for a reliable Chartered Accountant near you for handling Futures & Options (F&O) trading audit and ITR filing? We’ve got you covered! As a trusted F&O Tax Audit Consultant in Ahmedabad, we offer a special package priced at just ₹14,000 — tailored specifically for F&O traders to ensure smooth tax compliance and timely audit filing.

Here’s what our combo includes:

Proper Accounting of F&O Transactions – Clear and accurate records of all your trades.

CA-Certified Tax Audit Report – As required under Section 44AB of the Income Tax Act.

Income Tax Return (ITR) Filing – Filing of ITR-3 with all business-related details.

Digital Signature (DSC) – For secure and verified online submissions.

With expert CA support and complete documentation, you can stay worry-free and compliant with all F&O tax regulations.

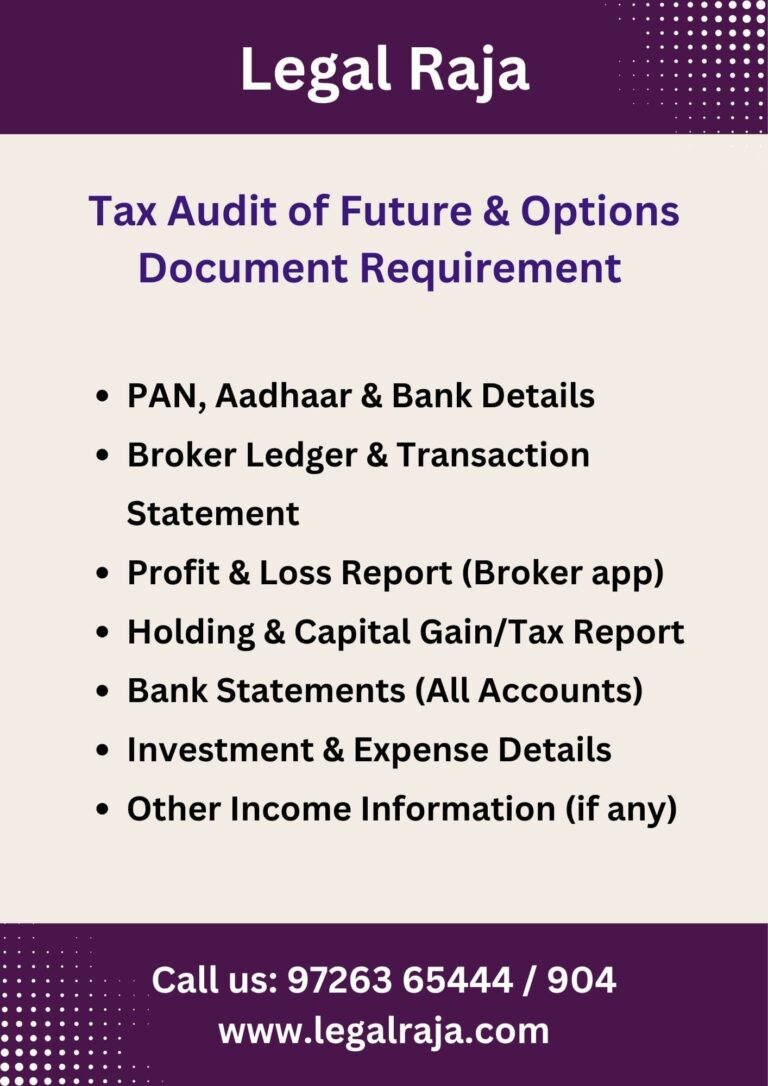

List of Documents Required for CA Audit of F&O

To accurately file your Income Tax Return (ITR) and conduct a Tax Audit for Futures & Options (F&O) or derivatives trading, the following documents are essential. These help ensure correct turnover calculation, audit reporting, and compliance under the Income Tax Act. As an experienced F&O Tax Audit Consultant in Ahmedabad, we assist you in collecting, reviewing, and processing these documents with complete accuracy:

PAN, Aadhaar & Bank Details

Broker Ledger & Transaction Statement

Profit & Loss Report (from broker app)

Holding & Capital Gain/Tax Report

Bank Statements (All Accounts)

Investment & Expense Details

Other Income Information (if any)

Audit Applicability for Derivative Traders in Ahmedabad

Turnover Above ₹10 Crore

Audit is compulsory if your F&O turnover crosses ₹10 crore in a financial year.

Turnover Below ₹10 Crore, But Low Profit

If your profit is less than 6% (digital) or 8% (cash) of turnover, and

You don’t opt for presumptive taxation (Section 44AD),

Then tax audit is also mandatory.

Presumptive Taxation Option

If you declare profit equal to or more than 6%/8%,

And opt for presumptive taxation,

Then audit is not required (in most cases).

Maintain Proper Records

You must keep books like broker statements, bank statements, P&L, etc.

File ITR-3

Since F&O is treated as business income, you need to file ITR-3, not ITR-1 or ITR-2.

Get Help from a CA

A Chartered Accountant in Ahmedabad will help you calculate turnover, prepare the audit report (Form 3CA/3CB + 3CD), and file your return on time.

Easy Guide to Calculating F&O Turnover for ITR

Only one owner (shareholder) is needed.

One nominee must be appointed.

Minimum one director (can be the same person as the owner).

Director must be an Indian resident.

Company name must be unique and end with “(OPC) Private Limited”.

Must follow all ROC filings and audit compliances.

Legal Raja is your trusted partner for F&O Tax Audit Consultant in Ahmedabad, helping you meet all legal requirements with ease and accuracy.

F&O Tax Audit by CA – Done in 3 Days Online

If you’re an F&O (Futures & Options) trader needing audit and tax filing, just send us your basic documents (trading report, bank statement, PAN, etc.). Our expert CA team will first prepare your Profit & Loss Statement and Balance Sheet based on your trades.

Once the financials are finalized, our Chartered Accountant will conduct the Tax Audit and prepare the audit report. We will send you the draft Audit Report and ITR for review before submission.

After your confirmation, we’ll file the Audit Report and Income Tax Return on the government portal. You will receive the CA-signed and UDIN-attached Audit Report digitally, and if required, we can also send a physical copy to your doorstep.

What F&O Traders in Ahmedabad Can Deduct While Filing ITR

F&O (Futures & Options) trader in Ahmedabad, you can reduce your taxable income by claiming certain expenses while filing your Income Tax Return (ITR). With the guidance of a professional F&O Tax Audit Consultant in Ahmedabad, you can ensure that all eligible deductions are correctly claimed under business income. These include brokerage charges, internet and phone bills, advisory or research service fees, electricity used for trading activities, and even depreciation on your laptop or computer. You can also claim rent for office space (if used for trading), fees paid to your CA, and subscriptions or tools used for market research. These deductions help you legally save tax—just remember to keep all related receipts and bills as proof.

Top F&O Trading Audit Services – Expert CA Near You

Legal Raja is your reliable partner for F&O Tax Audit and ITR Filing, offering expert consultancy for traders across Gujarat and India. Whether you are an individual trader or handling high-volume derivative trades, our team of Chartered Accountants (CAs) ensures accurate calculation of F&O turnover, preparation of Profit & Loss accounts, Balance Sheets, and timely filing of the Tax Audit Report and ITR.

Contact Legal Raja: 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving All India

Frequently Asked Questions on F&O Tax Audit

Is Tax Audit mandatory for F&O traders?

Yes, if your turnover exceeds ₹10 crore, tax audit is mandatory. Even if your turnover is lower but profit is less than 6% (for digital transactions), tax audit may still apply.

How is turnover calculated in F&O trading?

Turnover is the total of the absolute profit and loss from all F&O trades. You add up all positive and negative outcomes of squared-off positions.

Under which head is F&O income reported in ITR?

F&O trading income is considered business income and reported under the head “Profits and Gains of Business or Profession”.

Which ITR form is applicable for F&O traders?

Generally, ITR-3 is applicable if you are a trader declaring F&O income as business income.