ESIC Registration Service in Ahmedabad

Looking to register your business under ESIC Registration Service in Ahmedabad? Our expert team ensures a smooth and hassle-free process for employers. We handle everything from employer registration, employee enrollment, to compliance with the Employees’ State Insurance Corporation (ESIC) rules. Whether you’re starting a new business or expanding your team, we ensure your company meets all statutory requirements, offering reliable support and timely filing – all at an affordable cost.

Start Your ESIC Registration Today – Quick & Easy Process!

- ESIC Registration : ₹4,000

- Monthly ESIC Return Filing: ₹1,000

- Employee Enrollment: ₹300

📍Ahmedabad Service | Govt Compliant | Hassle-Free Process

Complete Guide to Employee State Insurance Scheme (ESIC)

The Employee State Insurance Scheme (ESIC) is a social security initiative by the Government of India that provides medical, financial, and maternity benefits to employees earning wages up to ₹21,000 per month. It is mandatory for businesses with 10 or more employees (in some states, the threshold is 20) to register under ESIC and contribute towards the scheme.

Through our ESIC Registration Service in Ahmedabad, we assist employers in completing the registration process, employee enrollment, and monthly compliance with ease. Under the scheme, the employer contributes 3.25% of the employee’s wages, while the employee contributes 0.75%. These contributions ensure benefits like medical care, maternity leave, cash compensation during sickness, and coverage for work-related injuries.

Businesses must register with the ESIC portal, maintain accurate employee records, and file monthly returns. Our expert team provides end-to-end support to help your business meet all ESIC legal requirements quickly and efficiently.

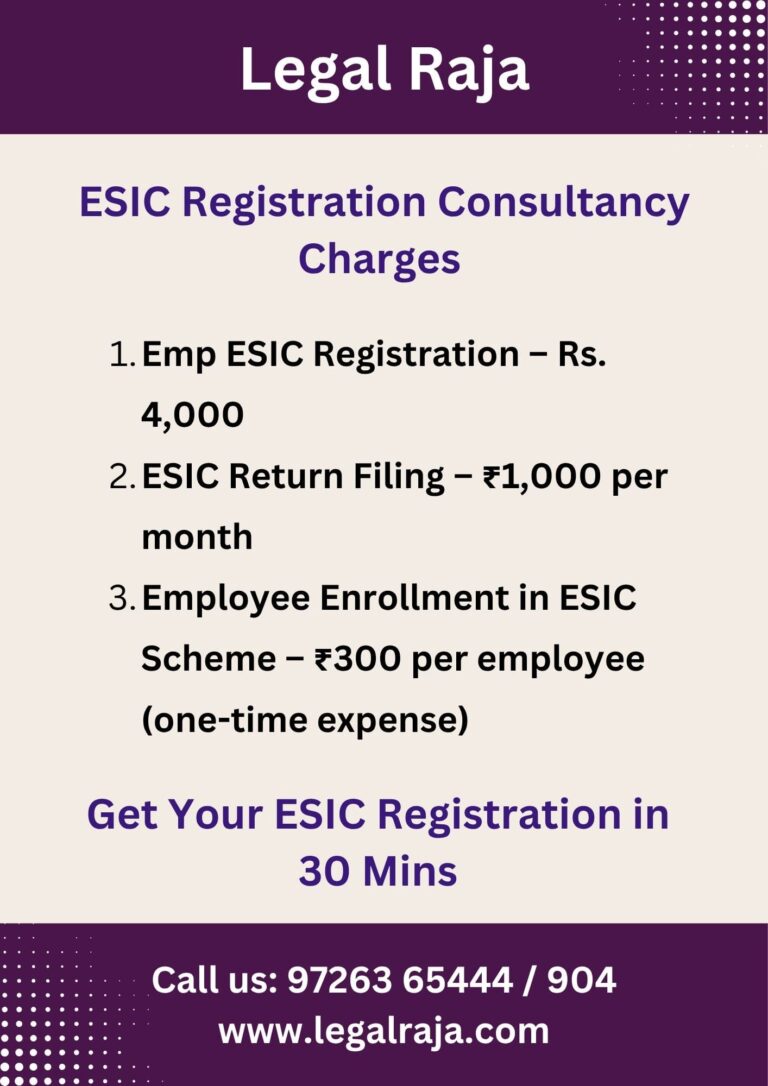

What Are the Consultancy Fees for ESIC Registration in Ahmedabad?

We are one of India’s most trusted ESIC Registration Service in Ahmedabad, offering complete support for registration, employee enrollment, and return filing under the ESIC scheme. Our process is smooth, fast, and fully compliant with government norms. Here’s our easy-to-understand pricing:

Employer ESIC Registration – ₹4,000 (One-time setup)

Monthly ESIC Return Filing – ₹1,000 per month

Employee Enrollment – ₹300 per employee (one-time cost)

Whether you’re just starting or looking to stay compliant, our expert team ensures your ESIC process is handled professionally and efficiently.

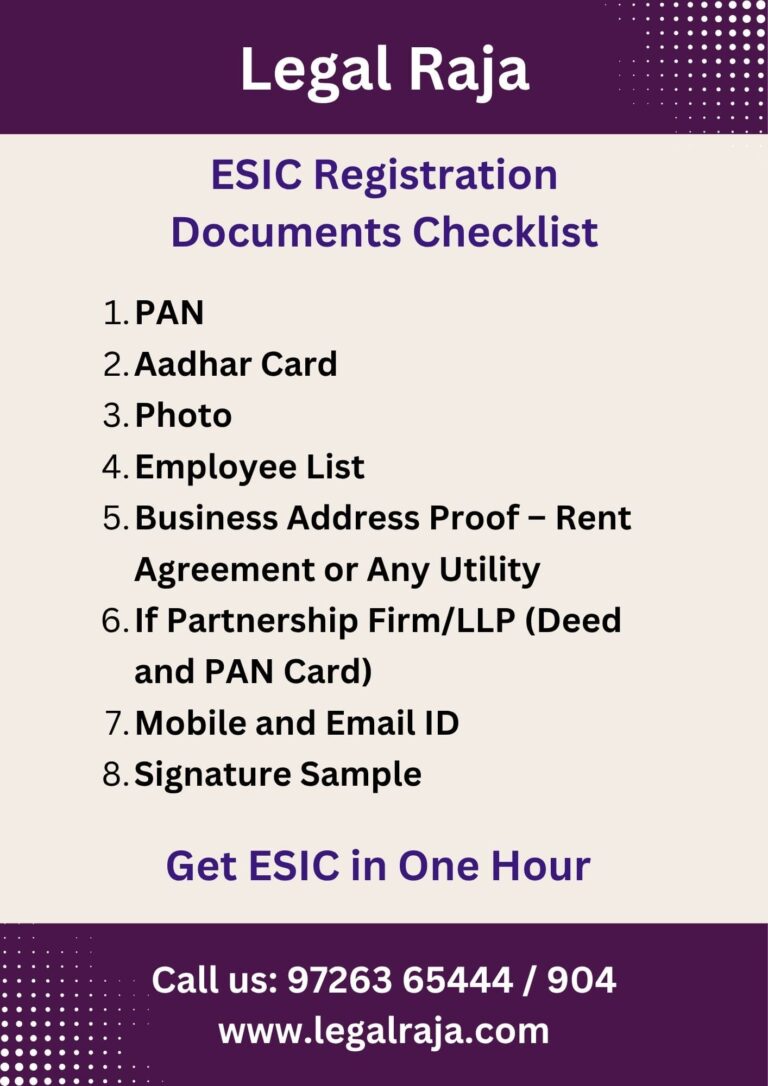

Required Documents for ESIC Registration in Ahmedabad

To register your business under the ESIC scheme, our ESIC Registration Service in Ahmedabad ensures a smooth and accurate process. You’ll need to submit a few essential documents to verify your identity, business details, and employee information. Here’s what you’ll need:

✅ PAN Card of Owner/Business

✅ Aadhar Card of Owner

✅ Passport-size Photograph

✅ Employee List with Salary & Joining Details

✅ Business Address Proof (Rent Agreement, Electricity Bill, or Tax Bill)

✅ Partnership Deed & PAN Card (if Partnership Firm/LLP)

✅ Mobile Number & Email ID

✅ Signature Sample of Owner/Authorized Signatory

Applicability of ESIC Scheme for Companies & Establishments

ESIC applies to your company, shop, or factory, both location and employee count are key factors. Here’s how to understand the applicability:

Is your establishment located in an ESIC-notified area?

No: ESIC is not applicable. You may consider a Workmen Compensation (WC) Policy.

Yes: Proceed to the next step.

Is the business activity seasonal in nature?

No: ESIC may not be mandatory.

Yes: Continue to the next step.

Total number of employees (including all staff):

Less than 10 employees: ESIC is not applicable.

10 or more employees: ESIC is mandatory for the organization.

Important Note: While the threshold is based on total employee count, ESIC coverage applies only to employees earning ₹21,000/month or less.

With our ESIC Registration Service in Ahmedabad, we help assess your eligibility, handle all documentation, and provide full support for registration and post-compliance.

Know Your ESIC Contribution Rates – A Simple Guide

Under the Employees’ State Insurance Scheme, both the employer and employee are required to contribute a fixed percentage of the employee’s wages every month. The current ESIC contribution rates are:

-

Employer’s Share: 3.25% of the employee’s gross monthly wages

-

Employee’s Share: 0.75% of the gross monthly wages

These contributions are mandatory for employees earning ₹21,000 or less per month. The total 4% (3.25% + 0.75%) ensures access to ESIC benefits such as medical care, maternity benefits, sickness pay, and disability coverage.

Timely payment and return filing are essential for compliance. We help employers manage ESIC contributions accurately and on time. With our expert ESIC Registration Service in Ahmedabad, we ensure all contributions are managed correctly, returns are filed on time, and your business remains fully compliant with ESIC rules.

ESIC Registration in Just 30 Mins – Start Your Process Today

Once you contact us, our ESIC expert will explain everything—rules, document requirements, compliance, and how the process works.

Send us the required documents. Our team will prepare and submit your ESIC application to the concerned department.

Within just 30 minutes, you’ll receive your official ESIC Registration Certificate. After registration, monthly ESIC return filing is mandatory, and we assist with that too.

What to Do After ESIC Registration? Complete Compliance Guide

Once your business is registered under ESIC, a few important monthly tasks must be followed to stay compliant:

Employee Enrollment: Add all eligible employees to the ESIC portal as they join.

Monthly Return Filing: File ESIC returns by the 15th of every month through the online portal.

Timely Payments: Deposit both the employer’s (3.25%) and employee’s (0.75%) contributions on time each month.

Following these steps ensures smooth ESIC operations and avoids penalties. Our expert team helps you handle all post-registration compliance with ease and accuracy.

Professional ESIC Consultant Near You – Start Now

Our ESIC Registration Service in Ahmedabad offers a smooth and hassle-free process for businesses of all sizes. Legal Raja provides expert consultancy to ensure full compliance under the ESIC Act across Gujarat and India. Our comprehensive services include employer registration, employee enrollment, contribution setup, and monthly return filing. Whether you’re a small business or an expanding enterprise, our professional team ensures quick ESIC Code generation and efficient post-registration compliance—so you can focus on your core business while we handle the legal formalities.

Contact Legal Raja: 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving All India

Frequently Asked Questions About ESIC Registration

Who is required to register under ESIC?

Any business with 10 or more employees (in some states, 20) and where employees earn ₹21,000 or less per month must register under ESIC.

Is ESIC registration mandatory for small businesses?

If the employee count is below the threshold or the business is outside an ESIC-notified area, registration is not mandatory. However, it can be opted voluntarily.

How long does ESIC registration take?

With proper documentation, registration can be completed in 30 minutes through our fast-track service.

What documents are required for ESIC registration?

Basic documents include PAN, Aadhar, photo, employee list, address proof, email, mobile number, and signature sample. For firms/LLPs, the deed and PAN are also needed.

What is the due date for ESIC return filing?

ESIC returns must be filed monthly before the 15th of the following month.