Complete Guide: New vs Old Income Tax Regime FY 2025-26

Welcome to our blog! This guide will help you understand the Complete Guide: New vs Old Income Tax Regime FY 2025-26. The Old Tax Regime lets you save tax using exemptions and deductions like HRA, LTA, and Section 80C, while the New Tax Regime has lower tax rates but fewer deductions, making it simpler and easier to file. We will explain who can choose which regime, compare tax rates, show the filing process, and list the documents you need. You will also learn the benefits of each regime and how to decide which one saves you more tax. Whether you are a salaried employee, freelancer, or business owner, this guide will make it easy to understand your options and plan your taxes smartly.

Introduction to Income Tax Regimes

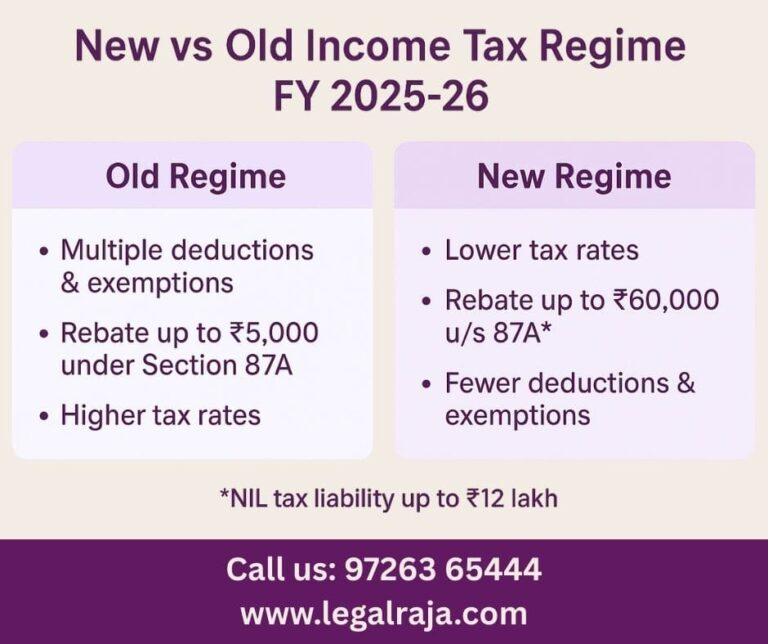

Income tax in India gives taxpayers the option to choose between two regimes: the Old Tax Regime and the New Tax Regime. The Old Tax Regime allows you to claim various deductions and exemptions, such as HRA, LTA, and investments under Section 80C, which can help reduce your taxable income. On the other hand, the New Tax Regime offers lower tax rates but comes with limited deductions, making it simpler and more straightforward for filing. Choosing the right regime depends on your income, investments, and overall tax-saving strategy. By understanding the features of both regimes, you can decide which one helps you save more tax and suits your financial planning.

Overview of Old vs New Tax Regime

Old Tax Regime

The Old Tax Regime is ideal for taxpayers who make significant investments in tax-saving instruments. It allows you to claim various deductions under sections like 80C (investments in PPF, ELSS, etc.), 80D (health insurance premiums), and 80E (education loan interest), among others. In addition, it provides exemptions such as House Rent Allowance (HRA) and Leave Travel Allowance (LTA), which can further reduce your taxable income. This regime is suitable for individuals who want to maximize their tax savings through investments and eligible allowances.

New Tax Regime

The New Tax Regime offers lower tax rates across different income slabs but comes with limited deductions. Only a few deductions are allowed, such as the employer contribution to the National Pension System (NPS), Employee Provident Fund (EPF), and a handful of others. This regime is designed for taxpayers who prefer a simpler and more straightforward tax system with less paperwork and fewer calculations. It’s ideal for those who do not have many tax-saving investments and want an easier way to file their taxes.

Key Differences Between Old and New Regime

| Feature | Old Tax Regime | New Tax Regime |

|---|---|---|

| Tax Rates | Higher slabs, but deductions reduce taxable income | Lower slabs, fewer deductions |

| Deductions | Multiple deductions like 80C, 80D, 80E, 80G, 80TTA | Very limited deductions (NPS employer contribution, EPF, few others) |

| Exemptions | HRA, LTA, standard deduction, medical reimbursement | Mostly not allowed |

| Filing Complexity | Moderate, requires tracking investments and exemptions | Simple, less paperwork and easier calculations |

| Suitability | Best for taxpayers with high investments and eligible exemptions | Best for taxpayers preferring simplicity and minimal documentation |

| Tax Planning | Encourages long-term tax-saving investments | Focuses on lower tax rates rather than investment planning |

| Flexibility | More flexible with multiple options to reduce tax | Less flexible, mostly fixed slabs |

| Impact on Salary Structure | Can optimize tax through allowances and reimbursements | Limited impact; salary structure has little effect on tax |

| Audit/Documentation | Requires proper proofs and documentation for deductions | Minimal documentation required |

Eligibility Criteria – Who Can Opt for Each Regime

Old Tax Regime:

Available to all individual and HUF taxpayers.

Ideal for those claiming multiple deductions and exemptions (HRA, LTA, Section 80C, etc.).

Suitable for taxpayers with significant investments in tax-saving instruments.

Beneficial for salaried individuals with structured salary components.

Good for taxpayers looking to reduce taxable income through eligible allowances.

Preferred by those who actively plan tax-saving investments each year.

New Tax Regime:

Open to all individual and HUF taxpayers.

Suitable for those preferring lower tax rates with fewer deductions.

Best for taxpayers who want a simpler and hassle-free tax filing process.

Ideal for freelancers, business owners, or individuals with fewer investments.

Helps avoid tracking multiple exemptions and paperwork.

Suitable for those who prioritize straightforward tax calculations over maximizing deductions

Incmoe Tax Slabs FY 2025-26

Income Tax Slabs for FY 2025-26

For FY 2025-26, taxpayers can choose between the Old and New Tax Regimes. Each regime has different income slabs and tax rates, helping you decide the best option based on your income and deductions.

| Income Tax Regime | Income Slab (₹) | Tax Rate |

|---|---|---|

| Old Tax Regime (Individual <60 years) | 0 – 2,50,000 | Nil |

| 2,50,001 – 5,00,000 | 5% | |

| 5,00,001 – 10,00,000 | 20% | |

| Above 10,00,000 | 30% | |

| New Tax Regime (Optional for all) | 0 – 3,00,000 | Nil |

| 3,00,001 – 6,00,000 | 5% | |

| 6,00,001 – 9,00,000 | 10% | |

| 9,00,001 – 12,00,000 | 15% | |

| 12,00,001 – 15,00,000 | 20% | |

| Above 15,00,000 | 30% |

Deductions Available Under Each Regime

Old Tax Regime:

Section 80C: Investments in PPF, ELSS, NSC, etc.

Section 80D: Health insurance premiums.

Section 80E: Interest on education loans.

Section 80G: Donations to charitable organizations.

House Rent Allowance (HRA).

Leave Travel Allowance (LTA).

Standard Deduction for salaried employees.

Other eligible allowances and exemptions to reduce taxable income.

New Tax Regime:

Employer contribution to National Pension System (NPS).

Employee Provident Fund (EPF).

Very few other minor deductions.

Designed for simplicity with minimal paperwork.

Exemptions Under Old and New Regime

The Old Tax Regime provides several exemptions that help reduce taxable income. Common exemptions include House Rent Allowance (HRA) for those living in rented accommodation, Leave Travel Allowance (LTA) for travel expenses, Conveyance Allowance for commuting costs, and House Loan Interest under Section 24 for homebuyers. These exemptions make the Old Regime suitable for taxpayers who want to maximize tax savings through allowances and investments.

On the other hand, the New Tax Regime does not allow most exemptions. Only a few specific allowances or contributions, such as the employer’s contribution to NPS or EPF, are permitted. This makes the New Regime simpler but less flexible in terms of reducing taxable income.

Charges and Fees Associated with Filing

Filing your Income Tax Return (ITR) can be confusing, but our professional Chartered Accountants (CAs) make it simple. We take care of preparing your ITR, computing your income (CoI), and certifying everything, so you don’t have to worry.

ITR Filing Charges:

Salaried ITR Filing: ₹1,000

Capital Gain / Share Gain-Loss ITR: ₹1,500

Business ITR – 44AD Return: ₹2,000

All Other ITR Filing: ₹3,000

Step-by-Step Process to File Under Each Regime

Filing your Income Tax Return (ITR) for FY 2025-26 is simple if you follow these steps:

Login to the e-Filing Portal

Go to the official Income Tax e-filing website and log in with your PAN and password.Select the Assessment Year

Choose FY 2025-26 for which you want to file your return.Choose Your Tax Regime

Pick either the Old Tax Regime or the New Tax Regime depending on your eligibility and preference.Enter Income Details

Fill in all your income sources like salary, business income, or capital gains.Add Deductions (if Old Regime):

If you chose the Old Regime, enter all eligible deductions and exemptions to reduce your taxable income.Check and Submit

Review all the details carefully, then submit your ITR using Aadhaar OTP, net banking, or other e-verification methods.Verify Your Return

Complete the process by verifying your ITR via OTP, Digital Signature Certificate (DSC), or by sending the signed ITR-V to the Income Tax Department.

Your Trusted Consultant for New vs Old Income Tax Regime FY 2025-26

Navigating between the Old and New Income Tax Regimes can be confusing, especially with changing tax slabs, deductions, and exemptions. At LegalRaja.com our team of expert Chartered Accountants helps you choose the regime that best suits your financial situation. We guide you step by step to maximize your tax savings, minimize errors, and ensure timely filing of your Income Tax Return (ITR).

Our professional services are affordable and reliable, starting at just ₹1,000 for salaried individuals. Whether you are filing a salaried ITR, capital gain ITR, or business ITR, our experts at LegalRaja.com make the process simple and stress-free. Call us today at +91 97263 65444 to get personalized guidance and secure your taxes the right way.