Annual Compliance Service for Private Limited

Staying compliant with company laws is essential for every registered business. At Legal Raja, we offer professional Annual Compliance Service for Private Limited companies, LLPs, and other entities in Ahmedabad. Our comprehensive services include ROC filing, AGM documentation, preparation of financial statements, and maintenance of statutory records.

Need a CA for Pvt Ltd Company Compliance?

Annual Filing Package

- Ac Finalization

- Statutory Audit

- ROC Filing

- MGT 7 and AOC 4

- DIN KYC

- ITR Filing

Rs. 19,000/-

Annual Compliance Service for Pvt. Ltd. in Ahmedabad

Private Limited Companies in India are required to follow a set of statutory compliance rules under the Companies Act, 2013 and the Income Tax Act. These compliances help maintain transparency, legal standing, and the smooth functioning of the business. Key compliance areas include annual ROC filings, conducting board and general meetings, maintaining statutory registers, filing income tax returns, and adhering to audit requirements.

Other important filings include DIR-3 KYC for directors, ADT-1 for auditor appointment, and Forms MGT-7 and AOC-4 for annual returns and financial statements. Failure to comply may result in heavy penalties, director disqualification, or legal action.

That’s why Legal Raja offers a trusted Annual Compliance Service for Private Limited companies in Ahmedabad. Our expert team ensures timely and accurate filings, so business owners can focus on growth while we handle all regulatory responsibilities with precision and care.

Pvt Ltd Annual Compliance Charges in Ahmedabad

Looking for a nearby and trusted consultancy for company compliance? Legal Raja offers professional Annual Compliance Service for Private Limited companies in Ahmedabad, supported by expert Chartered Accountants and transparent pricing. Whether you’re a startup or a growing business, our services help you stay fully compliant with ROC and Income Tax laws—quickly, accurately, and affordably.

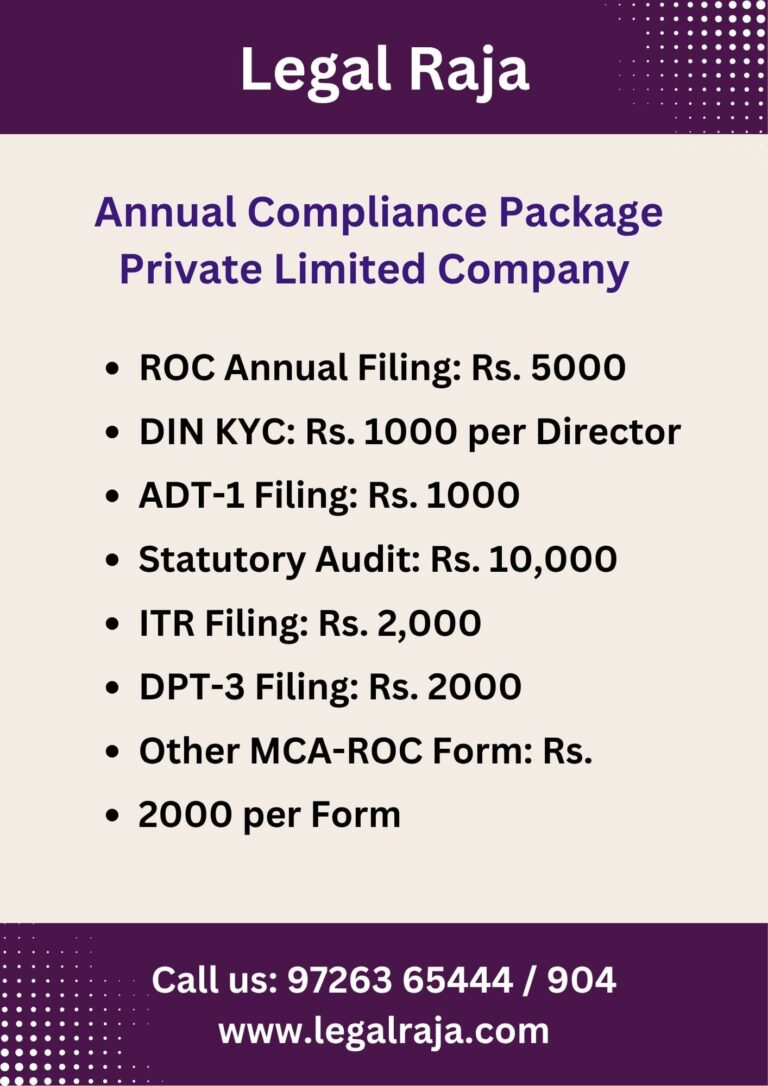

Our Charges for Company Annual Compliance:

✔ ROC Annual Filing (AOC-4 & MGT-7): ₹5,000 (Professional Fees)

✔ DIN KYC: ₹1,000 per director

✔ Auditor Appointment (ADT-1 Filing): ₹1,000

✔ Statutory Audit: Starts from ₹10,000 (based on turnover)

✔ Income Tax Return Filing: ₹2,000

✔ DPT-3 Filing (Loan Reporting): ₹2,000

✔ Other MCA/ROC Forms: ₹2,000 per form

We ensure timely and error-free filing, helping you avoid penalties while maintaining full compliance with the Companies Act. Contact Legal Raja today for smooth and affordable company compliance support in Ahmedabad.

Documents Required for Annual Filing – Pvt Ltd Company

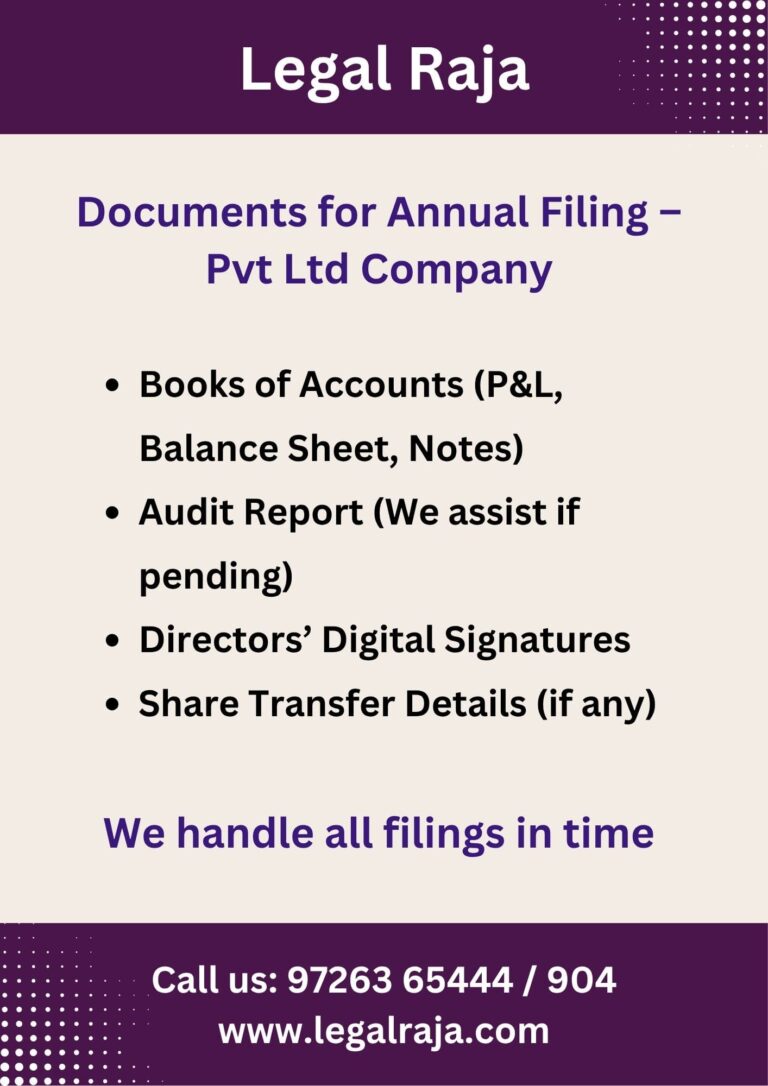

For annual compliance of a Private Limited Company, the key documents include:

Books of Accounts (Profit & Loss, Balance Sheet, Notes)

Audit Report (We provide audit services if pending)

Digital Signature of Directors

Share Transfer Details (if applicable)

We also offer Bookkeeping, Account Preparation, and Statutory Audit Services to ensure complete and timely compliance.

Annual Compliance Requirements for Pvt Ltd Firms in Ahmedabad

Annual Compliance Checklist for Private Limited Companies

Every Pvt. Ltd. Company in India must follow these key compliance requirements:

One-Time Compliance:

ADT-1: Auditor appointment (within 30 days)

INC-20A: Business commencement (within 180 days)

Annual ROC Compliance:

AGM & Board Meeting documentation

AOC-4: Financial statement filing (within 30 days of AGM)

MGT-7A: Annual return (within 60 days of AGM)

DIR KYC: Director KYC (before 30th June)

DPT-3: Loan return filing (before 30th June)

MGT-14: Resolution filing (if applicable)

MSME-1: For companies with MSME creditors

Tax & Audit:

Statutory Audit: Before 30th September

ITR Filing: Before 31st October

Tax Audit: If applicable, by 30th September

Event-Based Filings:

Change in directors, capital, registered office, or loans

Stay compliant and avoid penalties with expert support from Legal Raja.

Expert Chartered Accountant and Company Secretary in Ahmedabad

In today’s business environment, compliance plays a crucial role in building trust and credibility. For Private Limited Companies, timely filing of statutory returns, financial statements, and regulatory documents is essential—not only to avoid penalties but also to attract investors and secure funding. With due diligence becoming a standard part of investment decisions, maintaining proper compliance is more important than ever.

That’s where Chartered Accountants (CAs) and Company Secretaries (CSs) come in. These professionals ensure your business meets all ROC, MCA, and Income Tax requirements. At Legal Raja, we specialize in offering expert Annual Compliance Service for Private Limited companies in Ahmedabad, helping them manage audits, annual filings, and corporate governance with ease. Our mission is to keep your business legally compliant, transparent, and well-positioned for long-term growth.

Step-by-Step Process to Get Annual Compliance Service

Reach out to our team with your company’s compliance or annual filing needs. We’ll understand your business type and review your current compliance status to identify what filings are due.

Based on the analysis, we’ll prepare a custom checklist of required filings. We’ll also share a list of necessary documents and information needed to begin the process.

Once we receive all documents, our expert team will prepare and file all necessary forms with ROC, MCA, and Income Tax departments—ensuring everything is submitted accurately and on time.

Additional Mandatory Compliances for Private Limited Companies

After registering a Private Limited Company, it’s essential to complete a few important compliances to stay legally active and avoid penalties. Initially, one-time filings like ADT-1 (Auditor Appointment) and INC-20A (Declaration of Business Commencement) must be submitted to the ROC. As your business grows, event-based compliances—such as changes in directors, registered office, or capital—must also be reported. Every year, companies are required to file annual returns, including AOC-4, MGT-7A, and Income Tax Returns (ITR). Depending on your company’s activities and turnover, other filings like DPT-3, MSME-1, and statutory audit reports may also become mandatory.

At Legal Raja, we offer professional Annual Compliance Service for Private Limited companies in Ahmedabad. Our experts ensure all your company compliances are handled smoothly, accurately, and on time—keeping your business fully compliant and legally secure.

Pvt. Ltd. Company Compliance Consultant in Ahmedabad

Legal Raja offers complete Annual Compliance Service for Private Limited, covering all key filings such as Form 8, Form 11, ITR filing, and audit support. Our expert team of Chartered Accountants and Company Secretaries ensures that every filing is done accurately and on time, helping you avoid penalties and stay fully compliant with ROC and Income Tax regulations. With our trusted Annual Compliance Service in Ahmedabad, we simplify the compliance process for LLPs—serving clients across Gujarat and all over India.

- Contact Legal Raja: 9726365444

- Email: office@legalraja.com

- Head Office: Ahmedabad, Gujarat – Serving All India

FAQ's on Pvt Ltd Company Compliance

What is annual compliance for a Private Limited Company?

It includes mandatory filings like AOC-4, MGT-7A, ITR, auditor appointment, and maintenance of statutory records.

What are the penalties for non-compliance?

Failure to comply can result in heavy penalties, director disqualification, and legal action by ROC.

What forms are filed annually with ROC?

AOC-4 (financial statements) and MGT-7A (annual return) are mandatory ROC filings.

Is a statutory audit compulsory?

Yes, all Private Limited Companies must get their accounts audited annually, regardless of turnover.