ESIC Return Filing Consultant in Ahmedabad

Are you searching for a reliable ESIC Return Filing Consultant in Ahmedabad? Our expert team specializes in hassle-free ESIC compliance, monthly return filing, and employee registration services. We assist businesses of all sizes in meeting ESIC obligations on time to avoid penalties and legal issues. From data preparation to return submission, we handle the entire process with accuracy and efficiency—ensuring full compliance with the latest ESIC regulations.

Expert ESIC Advisory & Filing in Ahmedabad

- ESIC Contribution Calculation

- Return Preparation & Filing

- Payment Assistance

- Employee Addition/Exit Support

- Expert Consultation

- Up to 10 Emp – ₹499/month

- 11–25 Emp – ₹999/month

- 26–50 Emp – ₹1,499/month

- 50+ Emp – Custom Quote

Complete Guide to ESIC Return Filing Requirements

ESIC return filing is a mandatory process for businesses in Ahmedabad registered with the Employees’ State Insurance Corporation (ESIC) to ensure employees receive medical and financial benefits. Businesses with 10 or more employees (earning up to ₹21,000/month) must deduct 0.75% from employee wages and contribute 3.25% as the employer’s share, depositing these by the 15th of each month. Half-yearly returns, summarizing contributions and employee details, are due by May 11 (for October–March) and November 11 (for April–September). Accurate records and timely filings prevent penalties like 7–12% interest or fines. An experienced ESIC Return Filing Consultant in Ahmedabad can simplify this process by managing contributions, filings, and documentation—ensuring full compliance without stress. Connect with us for smooth filing of PF and ESIC compliances.

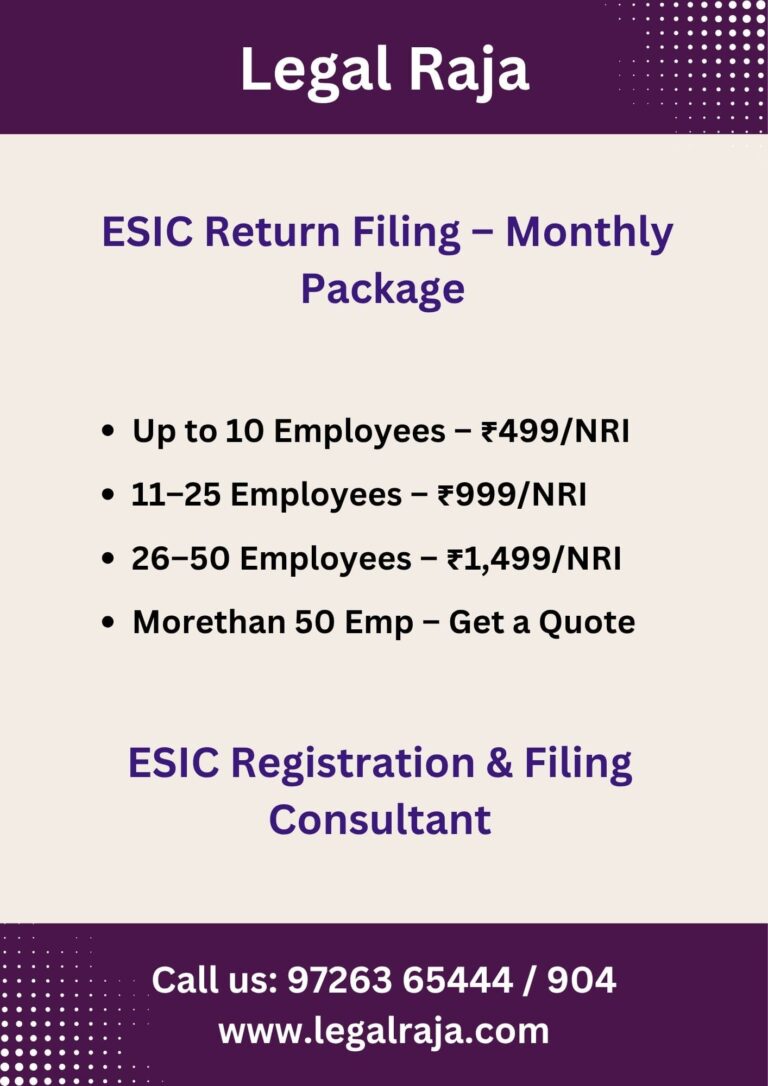

Cost of ESIC Return Filing Services in Ahmedabad

Our services are designed to be both affordable and transparent, tailored to meet the needs of businesses of all sizes. Charges vary based on the number of employees and the scope of service:

Up to 10 Employees: ₹499/month

11–25 Employees: ₹999/month

26–50 Employees: ₹1,499/month

Above 50 Employees: Custom Quote

Our ESIC Return Filing Consultant in Ahmedabad offers a complete package that includes:

✔ Monthly ESIC Contribution Calculation

✔ Return Preparation & Filing

✔ Payment Assistance

✔ Employee Addition/Exit Support

✔ Expert Consultation

There are no hidden charges – only clear pricing. GST extra as applicable.

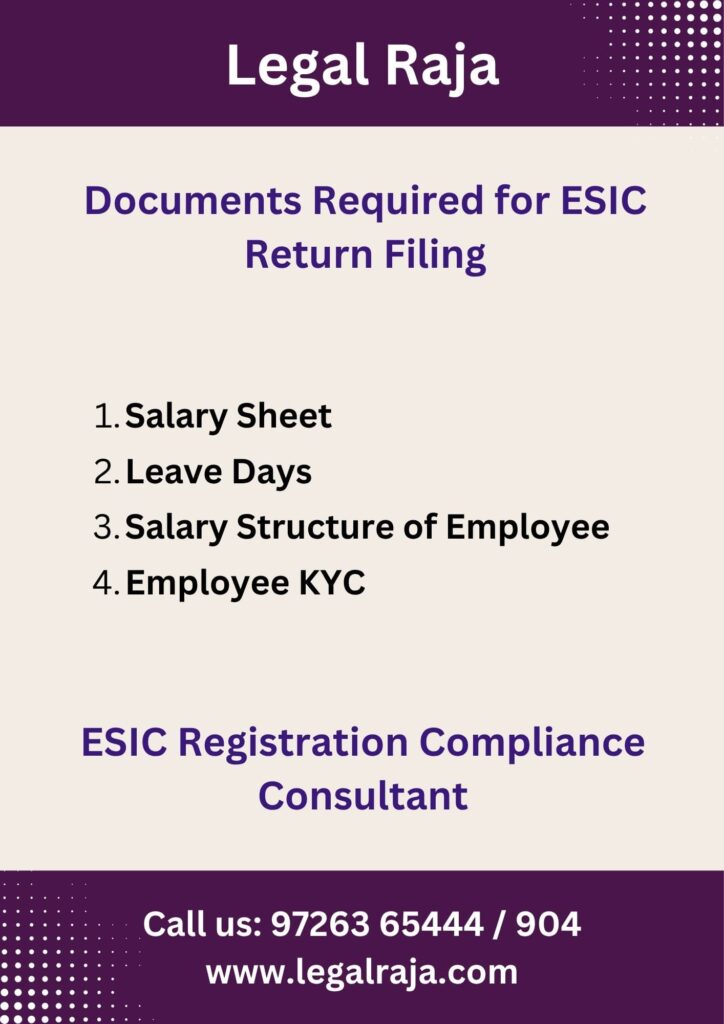

Checklist of Documents for ESIC Return Filing in Ahmedabad

To work with a trusted ESIC Return Filing Consultant in Ahmedabad, businesses must provide certain documents to ensure smooth and compliant ESIC return filing. Here’s a simple checklist to help you get started:

Salary Sheet

Leave/Attendance Record

Employee Salary Structure

KYC of New Employees (Aadhaar, PAN, Bank Details)

Providing these documents enables your ESIC Return Filing Consultant in Ahmedabad to prepare accurate returns and maintain compliance with ESIC rules.

Benefits of Outsourcing ESIC Return Filing in Ahmedabad

Outsourcing ESIC Return Filing Consultant in Ahmedabad simplifies compliance with ESIC regulations, saving businesses time and effort. Below are the key benefits explained in short, simple, and easy-to-understand words:

- Saves Time: Experts handle calculations, forms (like Form 5), and submissions, so you can focus on your business.

- No Mistakes: Professionals ensure accurate employee details and contributions, avoiding errors that lead to fines.

- Meets Deadlines: They file monthly contributions by the 15th and half-yearly returns by May 11 (Oct–Mar) or Nov 11 (Apr–Sep), preventing 7–12% interest or penalties.

- Simplifies Rules: Consultants manage the complex ESIC portal and regulations for you.

- Cost-Effective: Cheaper than hiring a full-time team to handle ESIC tasks.

- Employee Support: They update records and answer employee ESIC queries, ensuring smooth benefits.

- Covers PF Too: Most ESIC Return Filing Consultants in Ahmedabad also manage PF compliance, giving you a complete HR solution.

Monthly & Half-Yearly ESIC Return Due Dates Explained

-

Monthly ESIC Contribution Due Date:

– 15th of every following month (e.g., January wages → Due by 15th February) -

Half-Yearly ESIC Return Filing Dates:

– May 11 for the period October to March

– November 11 for the period April to September -

Late Filing Consequences:

– Interest @ 12% per annum

– Penalty ranging from ₹5 to ₹1,000 per day (as per ESIC rules)

Step-by-Step ESIC Filing Process for Businesses in Ahmedabad

Send us the necessary documents like employee salary details, attendance records, and your ESIC registration number. These are essential to begin your ESIC return preparation.

Based on the shared information, our team will prepare your ESIC return. You’ll receive a draft to verify employee contributions and ensure all entries are accurate before final submission.

After your approval, we will file the return on the ESIC portal. Timely and error-free submission ensures continued benefits for your employees and full statutory compliance.

PF and ESIC Return Filing Made Easy – Our Service Plan

1. Accurate Contribution Calculation

We calculate the PF and ESIC deductions for each employee based on their salary, ensuring all contributions match the official rates and rules.

2. Monthly Statement Preparation & Filing

Every month, we prepare and file your PF and ESIC returns with full details of employee and employer contributions – making sure your filings are 100% compliant.

3. Timely Payment Handling

We help you complete the monthly payments for PF and ESIC contributions on time, avoiding penalties and maintaining compliance.

4. New Employee Registrations

Onboarding a new employee? We’ll register them on both PF and ESIC portals smoothly and quickly, without disrupting your payroll.

5. Employer Contribution & CTC Analysis

We also calculate your share of the contributions and offer a clear view of total cost-to-company (CTC) impact, helping in better financial planning.

6. Ongoing Expert Guidance

Have questions or need clarity? Our consultants are always ready to guide you through PF and ESIC rules, updates, and best practices tailored for your business.

Trusted ESIC Consultant Near You for Filing & Registration

Legal Raja is your reliable partner for ESIC Return Filing Consultant in Ahmedabad, providing professional compliance support to businesses across Gujarat and India. Our ESIC service package includes everything – employer registration, employee onboarding, contribution calculation, monthly return filing, and expert advisory. From new registrations to regular filings, our team of experienced Chartered Accountants and Compliance Experts ensures your ESIC obligations are handled accurately and on time – all under one roof.

Contact Legal Raja: 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving Clients Across India

Frequently Asked Questions on ESIC Return Filing

Who is required to file ESIC returns?

Any employer registered under the ESIC Act with 10 or more eligible employees must file monthly and half-yearly ESIC returns.

What is the penalty for late ESIC payment or return filing?

Late payment attracts interest at 12% per annum and may also lead to penalties under the ESIC Act.

How can I register new employees under ESIC?

Employees can be registered through the ESIC portal by entering their Aadhaar, personal, and salary details. Each registered employee gets a unique ESIC number.

Can an ESIC return be revised after submission?

Yes, corrections can be made by filing a supplementary return with updated information.