Income Tax Return Filing Consultant in Ahmedabad

Filing your Income Tax Return (ITR) is a legal responsibility and a key part of managing your finances. As a reliable Income Tax Return Filing Consultant in Ahmedabad, Legal Raja offers hassle-free ITR filing services for individuals, salaried employees, and businesses. We ensure accurate filing, maximum tax benefits, and full compliance with income tax rules—quickly and professionally.

Expert Income Tax Return Filing Services Near You

ITR Return Filing Package

- 1,000 – Salary (ITR-1)

- 2,000 – Small Business

- 3,000 – Capital Gain

- 2,500 – Business Income

- 2,000 – LLP / Partnership

- 5,000 – Trust Return Filing

- 10,000+ – Audit Cases

📍 Expert CA Support | Accurate & Timely Filing | Ahmedabad Based Consultant

Income Tax Return Filing with Expert Guidance

Every year, Income Tax Return (ITR) filing can feel overwhelming for individuals and businesses alike. Under the Income Tax Act, 1961, anyone earning above ₹2.5 lakhs annually is required to file their return. The due date for most individuals is July 31st, while those requiring an audit have until October 31st. Proper classification of income—whether from salary, rent, capital gains, or business—is essential for accurate filing. Some income types may be tax-exempt, but once your total income crosses the threshold, reporting becomes mandatory.

As a leading Income Tax Return Filing Consultant in Ahmedabad, Vakil Adda offers expert support tailored to your specific needs. Backed by experienced Chartered Accountants, we handle over 1000+ ITRs yearly—offering not just return filing, but complete guidance on tax planning, deduction claims, and refund maximization. Whether you’re an individual or a business, we simplify your ITR filing with accurate calculations, timely submissions, and ongoing support. If you’re searching for a reliable ‘ITR Filing Consultant Near Me Legal Raja ensures local presence, professional service, and peace of mind in managing your tax responsibilities.

ITR Filing Charges by Chartered Accountant in Ahmedabad

At Legal Raja, we offer clear and affordable Income Tax Return (ITR) filing services for all types of taxpayers. Our experienced Chartered Accountants ensure accurate returns, timely submission, and maximum tax benefits—all at pocket-friendly rates:

Salary Income (ITR-1): ₹1,000

Small Business / Presumptive Income (ITR-4): ₹2,000

Capital Gains on Property: ₹3,000

Capital Gains from Shares & F&O Trading: ₹3,000

Business Income (ITR-3): ₹2,500

LLP / Partnership / Company Returns: ₹2,000

Trust Return Filing: ₹5,000

Audit Cases: Starting from ₹10,000 (based on scope)

Choose Legal Raja – Your Trusted ITR Filing Consultant in Ahmedabad, and leave the paperwork to us. We make tax filing smooth, simple, and compliant.

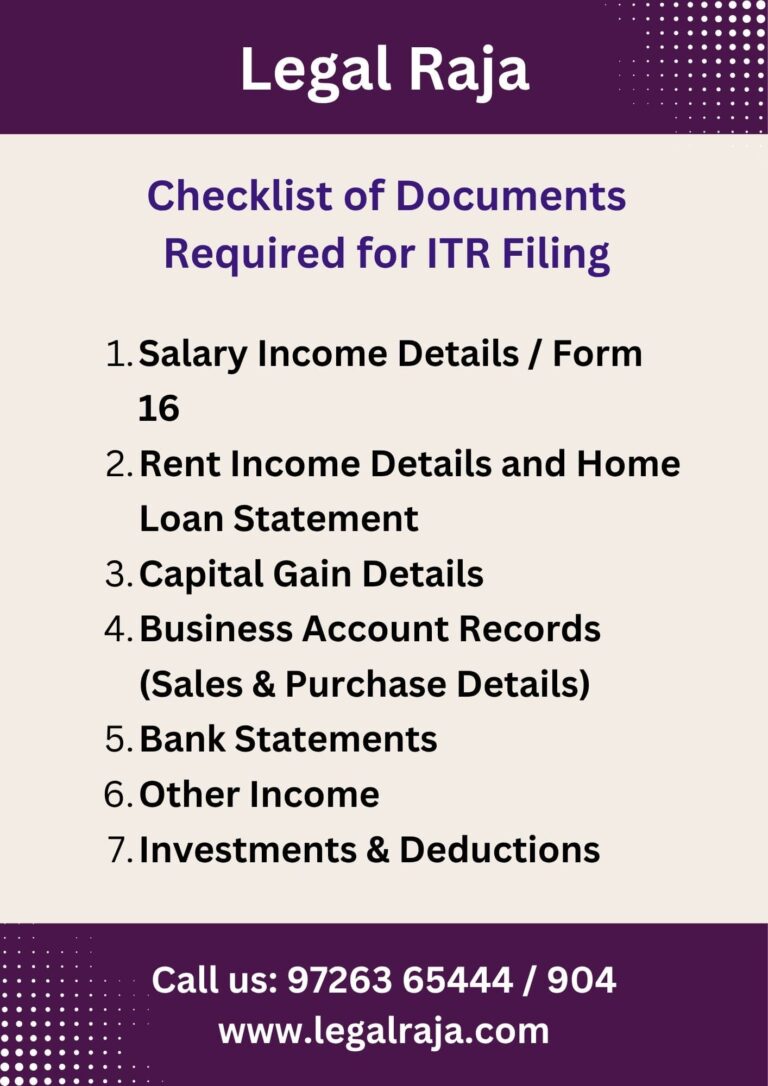

Checklist of Documents for Income Tax Return Filing

To ensure smooth and accurate online filing of your Income Tax Return, keep the following documents ready:

Form 16 / Salary Details

Rent Income & Home Loan Certificate

Capital Gain Statements (Shares, Mutual Funds)

Business Income (Sales & Purchase Summary)

Bank Statements

Other Income Details (Interest, Freelance, etc.)

Investment & Deduction Proofs (80C, 80D, etc.)

Auto-Fetched Reports (AIS, TIS, 26AS from portal)

These documents help ensure accurate and timely ITR filing.

Complete Guide to ITR Types and Their Applicability

The Income Tax Department has defined seven types of ITR (Income Tax Return) forms, each tailored to specific taxpayer categories and income sources. Choosing the correct form ensures accurate filing and full compliance. Here’s a quick breakdown:

ITR-1 (Sahaj): For salaried individuals with income from salary, pension, and other sources like interest (total income up to ₹50 lakhs).

ITR-2: For individuals with capital gains, foreign income, or agricultural income above ₹5,000, along with salary and other income.

ITR-3: For individuals and HUFs engaged in business or professional activities (non-presumptive).

ITR-4 (Sugam): For individuals, HUFs, and firms with presumptive income from small businesses (under Section 44AD, 44ADA, or 44AE).

ITR-5: For Partnership Firms and LLPs (except those required to file ITR-7).

ITR-6: For Companies other than those claiming exemption under Section 11 (income from property held for charitable purposes).

ITR-7: For entities such as Trusts, NGOs, and institutions required to file under Sections 139(4A) to 139(4D).

Filing the right ITR form is essential to avoid rejection, penalties, and mismatches. Always consult a tax expert to ensure correct form selection based on your income profile.

Top Benefits of Filing Income Tax Returns in Ahmedabad

Filing your Income Tax Return (ITR) offers several practical benefits beyond just tax compliance. As your reliable Income Tax Return Filing Consultant in Ahmedabad, Legal Raja ensures you get maximum value from timely and accurate ITR filing.

Key Uses of ITR Filing:

✔ Home Loan Application – Banks require ITRs to verify income stability

✔ VISA Application – Embassies ask for ITR as financial proof

✔ Children’s Overseas Education – Acts as income proof for sponsors

✔ Education Loan for Children – Required by banks for student loan eligibility

✔ Business Funding & Loans – Shows financial credibility for business loans

✔ Government Tenders – Mandatory for contractor registration and bidding

✔ Subsidy Scheme Application – Needed to avail government financial schemes

✔ Tax Refund Claims – Essential to receive excess TDS or tax refunds

✔ Address & Nationality Proof – Accepted as supporting documents for verification

Legal Raja helps individuals, professionals, and businesses in Ahmedabad file ITRs smoothly, ensuring all compliances are met while unlocking these key financial benefits.

Quick & Easy Online ITR Filing – Done in 30 Mins

Send us the necessary documents based on your income type (salary, business, capital gain, etc.). Not sure what’s needed? Our team will guide you with a quick document checklist.

Our expert CA will prepare your ITR along with a Certificate of Income (COI). You’ll receive a draft copy to review. Once you approve, we’ll proceed with final filing.

A senior CA will cross-check and complete your online ITR filing. You’ll get the final ITR copy along with CA-attested COI for your records and future use.

ITR Filing Guide by Popular Taxpayer Categories

In India, different types of taxpayers are required to file Income Tax Returns based on their income source and activity. Here are some of the most common categories:

Stock Market & F&O Traders:

Individuals who trade in shares, intraday, or Futures & Options must file ITR. If trading volume is high, a tax audit may also be required under the Income Tax Act.Small Business Owners (Presumptive Tax):

Businesses with a turnover below ₹1 crore often opt for presumptive taxation (under ITR-4) to simplify their filing process with fixed profit estimation.Salaried Individuals:

People earning through salary usually file ITR-1, often to claim tax refunds, declare savings, or for financial purposes like loans and visa applications.

Find Trusted ITR Filing Consultant Near You

Legal Raja is your trusted Income Tax Return Filing Consultant in Ahmedabad, serving individuals, professionals, and businesses across Gujarat and all over India. We offer a complete ITR Filing Service Package that includes document review, income classification, accurate filing, CA-attested COI (Certificate of Income), and guidance on tax savings – all in one place.

- Contact Legal Raja: 9726365444

- Email: office@legalraja.com

- Head Office: Ahmedabad, Gujarat—Serving All India

Frequently Asked Questions About ITR Filing

Who needs to file an Income Tax Return (ITR)?

Anyone with income above the basic exemption limit (₹2.5 lakhs) or who wants to claim a refund, loan, or visa.

What is the last date to file ITR?

For individuals (non-audit cases), the due date is July 31st each year.

Can I file ITR without Form 16?

Yes, if you have salary slips, bank details, and other income proofs.

How do I claim a refund in ITR?

By declaring accurate TDS/TCS or advance tax details, any excess tax paid is refunded automatically to your bank account after processing.