80G Registration Consultant in Ahmedabad

Getting 80G Registration is a smart move for Trusts, NGOs, and Section 8 Companies that wish to provide tax benefits to their contributors. With 80G approval from the Income Tax Department, your donors become eligible for tax deductions—boosting your credibility and fundraising potential. Partnering with an experienced 80G Registration Consultant in Ahmedabad ensures a hassle-free journey, from document preparation and application filing to final approval and ongoing compliance.

Start Your 80G Registration Process in Ahmedabad Now!

- Document Preparation

- Online Filing & Compliance

- Query Handling & Follow-ups

- Final Certificate Delivery

Rs. 30,000/-

📍 For Trusts, NGOs & Section 8 Companies | Ahmedabad-Based Support

Understanding 80G Registration Rules in Ahmedabad

Under Section 80G of the Income Tax Act, 1961, NGOs, Trusts, and Section 8 Companies in Ahmedabad can provide tax exemptions to their donors—enhancing fundraising potential. This registration not only strengthens donor trust but also incentivizes contributions by allowing tax deductions on donations.

To be eligible, the organization must be properly registered under applicable laws (such as the Societies Act, Trust Act, or Companies Act), should not use income for personal gain, and must maintain accurate financial records. The NGO must also function solely for charitable purposes with full transparency.

Working with an experienced 80G Registration Consultant in Ahmedabad ensures that all legal requirements are met, documents are correctly filed, and the process is completed efficiently. A professional consultant helps you navigate local compliance rules and avoid delays, making your organization ready to attract donor funding with confidence.

What Is the Cost of 80G Certification in Ahmedabad?

Our expert 80G Registration Consultant in Ahmedabad offers complete assistance at a transparent consultancy fee of ₹30,000. From preparing accurate documents to online filing and timely follow-ups, we handle the entire process professionally. Based in Gujarat’s business hub, Ahmedabad, we ensure a smooth, compliant, and stress-free registration journey for your Trust, NGO, or Section 8 Company. Let us take care of the legal formalities — so you can focus on your mission.

✅ Fast & Hassle-Free Process

✅ Dedicated Ahmedabad Support Team

✅ End-to-End Guidance Till Approval

Get started today with our Ahmedabad-based expert service!

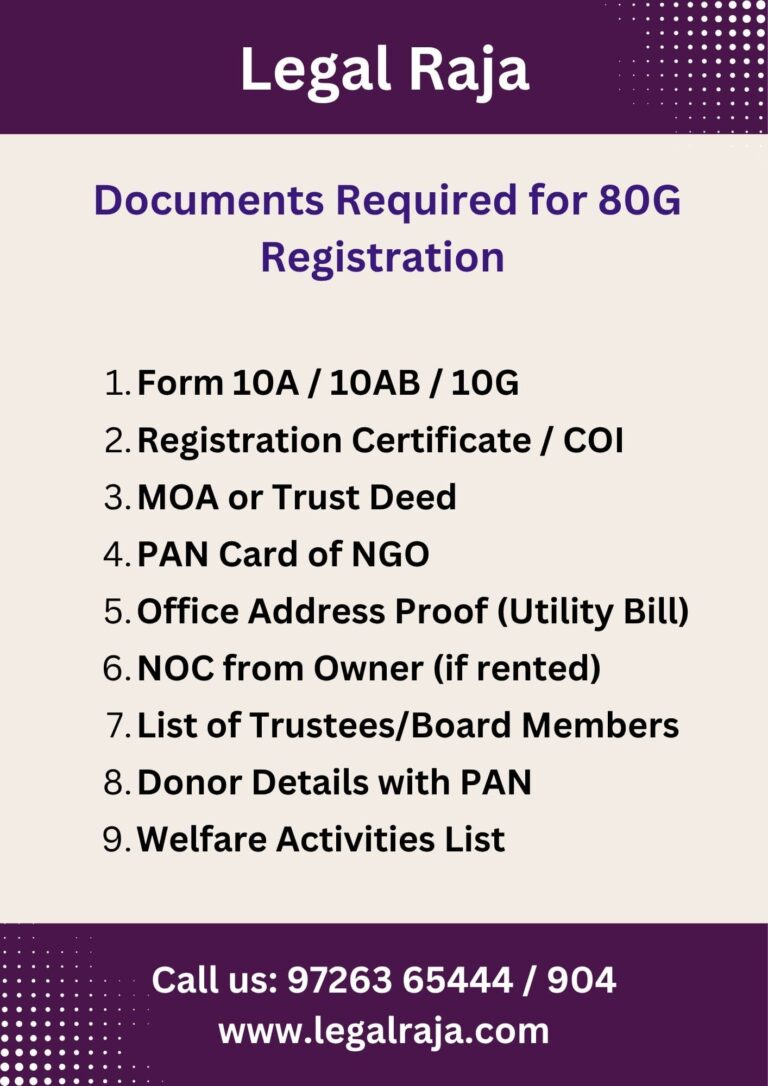

Documents You Need for 80G Registration in Ahmedabad

Form 10G / 10A / 10AB (Application Form)

Certificate of Incorporation / NGO Registration Proof

MOA (for Societies/Companies) or Trust Deed (for Trusts)

PAN Card of the NGO

Office Address Proof (Utility Bills like electricity/water/property tax)

NOC from Owner (if office is rented)

List of Trustees/Board Members with contact details

Donor Details (Names, Addresses, PANs)

Proof of Welfare Activities (Reports, photos, summaries)

Eligibility Guide for 80G Income Tax Benefits

To claim 80G registration and offer tax benefits to your donors, your NGO must meet specific eligibility conditions under the Income Tax Act. This ensures only genuine, socially active organizations get approved.

Key eligibility points include:

The NGO must be registered as a Trust, Society, or Section 8 Company.

It should have a valid PAN card in the name of the organization.

The organization must not promote religious or business activities.

All income and funds must be used strictly for charitable purposes.

Proper books of accounts and activity records must be maintained.

The NGO should have a clean legal record (no misuse of funds or blacklisting).

Meeting these criteria ensures your NGO is trusted for tax exemptions and donations. Our 80G Registration Consultant in Ahmedabad offers complete support to ensure your application meets all eligibility norms, making the process smooth, compliant, and hassle-free.

How to Renew Your 80G Registration on Time

Renewing your 80G registration is essential to continue offering tax benefits to donors and maintain your NGO’s compliance status. As per the Income Tax Act, 80G certificates now come with a validity period and must be renewed within the prescribed timeline to avoid penalties or loss of exemption.

Here’s how to ensure timely renewal:

Track Validity Period: Most 80G registrations are valid for 5 years. Start the renewal process at least 3–6 months before expiry.

File Form 10AB: Submit the renewal application using Form 10AB on the Income Tax Portal.

Prepare Updated Documents: Include activity reports, financials, PAN, registration certificate, and other required documents.

Respond to Queries: If the department seeks clarification, respond promptly to avoid rejection or delay.

Get Fresh Order: Upon approval, you’ll receive a new 80G certificate with renewed validity.

Our 80G Registration Consultant in Ahmedabad helps ensure your renewal is done correctly, on time, and without hassle — so your NGO can continue receiving tax-exempt donations smoothly.

Complete Process for 80G Registration Explained

You need to apply to the local Income Tax Commissioner (Exemptions) by filing the 80G application form online.

After receiving your application, the department will review your documents. They may also visit your NGO office to verify your setup and activities.

If the officer needs more clarity or paperwork, they’ll ask for it. Just submit the required details quickly to avoid delays.

Once everything is in order, the department will approve your application and issue the 80G certificate. This lets your NGO give tax benefit receipts to donors.

80G Registration – Recent Norms and Amendments

Fixed Validity: 80G certificates are now valid for 5 years, not for lifetime.

Timely Renewal: Renewal must be done through Form 10AB, at least 6 months before expiry.

Revalidation Required: Old 80G approvals had to be revalidated by June 30, 2021 — now every NGO must renew periodically.

No Grace Period: There’s no leniency for late renewals — delay can cancel your 80G benefits.

Simplified Compliance: 80G and 12AB processes are now streamlined under a unified tax compliance system.

Stay updated and renew on time to continue offering tax benefits to your donors. Need help? Our Ahmedabad-based consultants are ready to guide you!

Quick 80G Certification Help Near You

Legal Raja is your trusted 80G Registration Consultant in Ahmedabad, offering expert support for NGOs, Trusts, and Section 8 Companies across Gujarat and India. We provide a complete 80G Registration Package that includes everything – documentation, drafting, Form 10A/10AB filing, PAN verification, activity reporting, and end-to-end coordination with the Income Tax Department. From initial consultation to post-approval compliance, our experienced Chartered Accountants and Legal Experts ensure a smooth, fast, and fully compliant 80G certification process — all under one roof.

Contact Legal Raja: 9726365444

Email: office@legalraja.com

Head Office: Ahmedabad, Gujarat – Serving All India

FAQ’ About 80G Registration Consultant

What is 80G Registration?

80G Registration allows NGOs, Trusts, and Section 8 Companies to offer tax deductions to donors under Section 80G of the Income Tax Act.

Why should I hire an 80G Registration Consultant?

A consultant ensures your documents are in order, files the application correctly, tracks updates, and avoids delays or rejections.

How long does the 80G registration process take?

It typically takes 4–8 weeks, depending on document readiness and department response.

What documents are needed for 80G registration?

PAN, registration certificate, MOA/Trust Deed, activity proof, audited accounts, donor details, and office proof (with NOC if rented).